Time is the most valuable resource loan officers have when it comes to creating a high-revenue-producing business. Therefore, it’s important to know how to qualify leads for mortgage loans immediately.

The top reasons borrowers are rejected for loans are:

- A low credit score

- Recent negative credit history

- Bankruptcy

- Debt-to-income ratios.

Key Takeaways

- Qualifying leads is important in the mortgage loan industry to avoid wasting time and focus on the right deals.

- Qualified leads are those who meet all the criteria to conduct business with you until the deal is closed, while unqualified leads do not meet the qualifications.

- Effective communication, personalized landing pages, educational content, local listings, lead categorization, focusing on your specialization, social media, targeted advertising, and automation are ways to attract qualified leads.

- Qualifying your leads creates better closing rates and helps you meet your business goals.

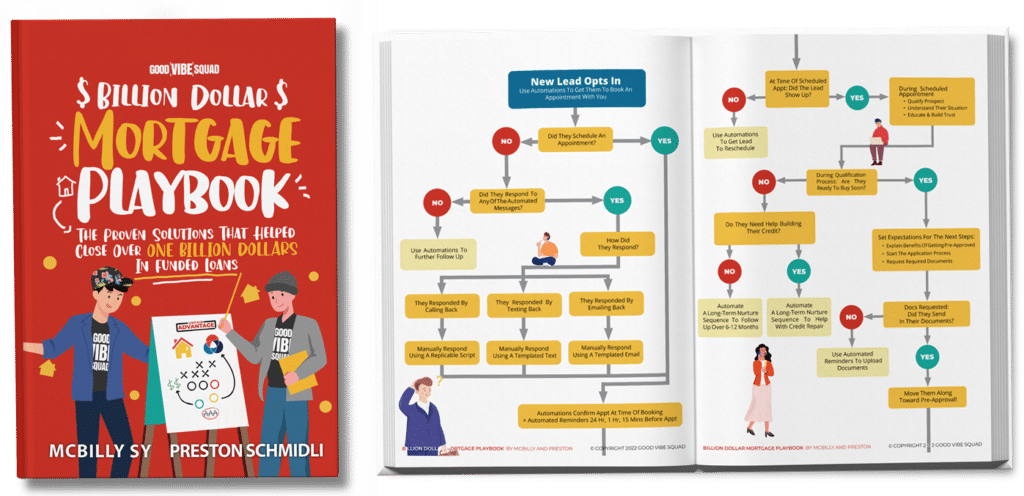

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

At the beginning of 2019, 78% of Americans were living paycheck to paycheck. COVID-19 left 33.5 million Americans filing for unemployment. These factors have a significant impact on the mortgage loan industry.

The mortgage loan pre-approval process has always been the most important step in the lead qualification stage of the sales cycle. Therefore, we are sharing our guide on how to qualify leads for mortgage loans.

Considering the economic factors mentioned above, it is crucial to have quality leads for your business to avoid wasting your time and your prospect’s time. Mortgage lead generation should follow an efficient process of qualification and appropriate funnel delegation.

What is a qualified lead?

A qualified lead is someone who meets all the qualifications to conduct business with you all the way to the close of the deal.

An unqualified lead may be interested in doing business with you. However, they don’t meet the criteria.

For example, Jane Smith is an excited, first-time homebuyer with good credit, but she doesn’t have enough money for the down payment. Instead of spending extra time with her, disqualify her immediately and send her through a lead-nurturing financial education funnel that teaches her how to save for her future home.

Another example is someone who has poor credit and won’t meet the criteria of any of your lenders. You would disqualify them. However, you can send them through your debt repair lead nurturing funnel.

Both are unqualified leads that may convert into future clients once they meet the qualifications.

Importance of lead qualification

Lead qualification is the most important step in the sales cycle. If you don’t take the time to prequalify your lead ahead of time, you will end up spending hours, days, and even weeks focusing on a deal that won’t close. Focusing on the wrong deal means you lose out on genuine deals.

Your attention needs to be focused on the right things to be successful.

How to qualify leads and prospects for mortgage loans

Qualifying mortgage leads is an easy process. If you are organized and have a streamlined process, it can be fast-paced. If you automate the process, you save even more time. We have a fully automated mortgage lead generation and qualification process that saves time.

You need to make sure you’re asking the right questions from the beginning when you’re qualifying your mortgage leads. You need to make sure they are ready to buy. You also need to make sure they are financially capable of handling the responsibility of a long-term financial commitment.

Loan managers have their own set of qualification questions. However, you can believe that all of them target the top criteria pieces.

- Debt

- Income

- Cash assets on hand

Some questions you can ask to make sure you know how to qualify leads and prospects are:

1. How did you hear about me?

In many cases, you may already know the answer to this question, such as if the lead came through a form response through your website, but if not, it is an important question to ask. Knowing how a lead finds your business can help you better track which marketing methods or referral partners are proving more successful when it comes to quality lead generation.

2. What are your goals?

This is a great question to ask because it allows you to know upfront how much thought the buyer has put into purchasing or refinancing a property. If they seem confused or wishy-washy, you may be talking to someone who just got an idea to start checking on buying a home.

Knowing a prospect’s goals will allow you to see a clear picture of how you can help them.

3. What is your timeline for buying a home?

This question is important because some prospects are ready to buy ASAP, and some of them are looking to buy in the future. A person trying to buy within the next three months is different from a person looking to buy six months or later.

Knowing when a person is ready to buy allows you to offer them a great customer service experience. If a buyer says they want to buy later, you just send them through the appropriate funnel once you get more information from them.

Find out why they are waiting, and you can send them appropriate information to make buying an easier choice for them in the future.

A home buyer ready to buy now is getting warmer. You just need to qualify them financially.

4. What type of property are you looking for?

This question is important because you need to make sure your lender offers a specific type of loan needed for certain property types. Never assume that someone is just looking for a dream home. Some people are looking for investment homes and may need a loan that includes a repair budget.

5. What location do you want to buy from?

This question will allow you to showcase your market expertise when you offer properties in your jurisdiction. It may be a waste of time if the person you are working with wants to find a home in another state with different regulations.

6. What is your budget?

Knowing the budget is a part of the financial qualification. Some people don’t realize they need a certain income level for specific loan amounts. Knowing the budget also allows you to determine the lenders you have access to.

You also need to confirm how much money they have available for a down payment. Asking this allows you to know if the borrower has a realistic expectation of the market. You want to make sure the person you’re talking to can afford the down payment, mortgage payment, insurance, and taxes.

7. Have you been pre-approved by a lender?

This is a good question to ask because it allows you to see if they are already talking to other lenders. It’s good to know if you’re being compared to other lenders. This allows you to step up your customer service game. It also lets you know that the person is serious about moving forward if they’ve been pre-approved already. You may be able to offer better terms.

8. Are you familiar with the lead qualification process?

While this question may seem straightforward enough, it can actually tell you a lot about a potential lead. For example, if your lead says they are familiar with the process but are a first-time homebuyer, chances are they have either already done their own research or that they have already been talking with your competition and are simply shopping for the best loan officer and offers. This information can be beneficial when it comes to categorizing your lead later in the process.

Tips on how to attract qualified leads

When it comes to lead generation, you must focus on methods and tools that will help you filter out those leads that are more likely to close. You don’t want to waste time nurturing leads that are unlikely to follow through. These tips can help you more effectively draw in qualified leads that will quickly lead to closings.

1. Start with effective communication

Whether you are a new loan officer or a seasoned veteran, you know that the mortgage industry is a people business. Learning how to effectively communicate with every new lead allows you to filter out those who you do not believe are likely to close and instead focus your attention on those that are.

2. Create personalized landing pages

As a loan officer, it is important for you to take advantage of all the lead generation technology available, especially in today’s digital world. One key tool to use to your advantage is the implementation of landing pages on your website. These pages are SEO designed to appear in search results based on specific keywords, with the ultimate goal of encouraging visitors to take action, such as filling out an information request. The tighter your keyword focus on a specific page, the greater your ability to pre-qualify your leads to your specific client persona.

3. Educating potential leads through quality content

As a loan officer or mortgage broker, one of the most important tools you have when it comes to qualified lead generation is your industry knowledge. Offering quality and educational content on your website helps to build trust with first-time visitors as well as help encourage these visitors to provide contact information. Creating a written blog or a series of educational videos is a great way to share your knowledge and answer borrowers’ questions on their first visit. Other features you can offer include infographics that explain key industry terms, address interest rate trends, offer checklists for homeowners looking to refinance, and regular newsletters that provide up-to-date information.

4. Take advantage of local listings

For most loan officers, local business is your core target market. Listing your business through local directories, such as through a Google Business Profile, can help ensure that your business appears on local search results and Google Maps. In addition, this type of listing allows you to collect reviews from clients that can help build your business credibility and help drive qualified leads to your website.

5. Categorize your leads to save time

As more and more leads come in, you will want to consider implementing some form of lead categorization that breaks down your leads based on the stages they may be in. For example, you can break down leads based on where they may be in your sales funnel. If you do this through a CRM, you can actively move leads from one category to another as they progress. Through automation, you can trigger specific tasks, such as emails or phone calls, to help them progress through to closing.

6. Focus on what you specialize in

The mortgage industry is a highly competitive industry and in order to generate qualified leads, you need to stand out above your competition. One way to do this is to focus your mortgage marketing efforts on your niche in the industry. Maybe you work best with a certain demographic or focus your efforts on a specific area of the mortgage business. For example, if you specialize in FHA loan programs, then you want to target your efforts to borrowers looking at FHA mortgages.

7. Take advantage of social media

We have already mentioned how important effective communication is when working to qualify your leads, so what better platform to focus on than social media? Here you can implement many of the tips already listed, such as sharing educational material, directing potential leads to your landing pages, and effectively communicating with followers by engaging in conversation and answering their questions. Determine which social media platforms, such as Facebook or LinkedIn, are most popular with your target audience and focus on those platforms.

8. Target your advertising

While your advertising strategy focuses on lead generation, bringing in hundreds of leads that are not ready to close will only create more work. By creating advertising campaigns that specifically target your ideal customer persona instead of a wide range of borrowers, you are more likely to attract the high-quality leads you are looking for.

9. Automate your process

With a quality mortgage CRM, you have access to a wide range of automation tools that can help you organize and categorize your leads and allow for more efficient lead management. When integrated with your website landing pages, leads can automatically be entered and placed in their appropriate category, as well as trigger additional tasks, such as a welcome email or follow-up phone call. The use of automation in your lead generation strategy can help to streamline your workload and leave you more time to focus on other areas.

Qualifying your leads creates better closing rates

Prioritizing the generation of qualified mortgage leads in your marketing strategy can help ensure your focus is on leads that are more likely to close and generate business, helping you meet your business goals. With the right strategies in place, including automation, you can create a steady stream of quality mortgage leads and know which ones deserve your immediate focus in order to convert to a closing client.

We can help you generate qualified leads today

At Good Vibe Squad, we understand the importance of qualifying mortgage leads when it comes to your business success. We offer a powerful combination of services including a mortgage CRM, loan officer coaching, and mortgage lead generation that can help take your business to the next level. To learn more about the services we offer, book a strategy call today.