Mortgage Lead Generation Services

Get Pre-Qualified, Exclusive Mortgage Leads Delivered Straight To Your Pipeline

Our mortgage lead generation company helps loan officers by providing a steady stream of pre-qualified mortgage leads that are more likely to convert into actual business. This can save you time and frustration, and allow you to focus on what you do best – closing deals and helping your clients achieve their dream of homeownership.

One of the #1 stressors as a loan officer is chasing after high-quality mortgage leads. It’s incredibly frustrating trying to lock down a consistent stream of leads to feed your business (especially when you’re stuck wasting your time cold-calling junk leads that don’t want your help).

So what separates the bad leads from the good ones? Why do some leads end up being a huge waste of time, meanwhile others convert?

And how do you know once you’ve found viable mortgage sales leads? And more importantly, how do you capture (and retain) that lead’s attention, so you can convert them all the way to the funded loan? We’ll answer all these questions and more. But first, let’s break down the biggest difference between junk leads VS leads that convert…

The Problem With Mortgage Leads: There’s zero TRUST built in for you in the beginning.

If you’re used to getting referral leads from your realtor partner, you know that most of these referral leads are a slam dunk deal compared to leads you buy off the internet. The reason why referrals are SO MUCH EASIER to convert is because there’s already built-in trust equity between that lead and their realtor. They’ve already been “warmed up” before speaking to you.

But with any other leads, you have to work a little harder at building that relationship, gaining their trust, capturing their attention, and keeping their attention over the long term.

Taking a cold lead, warming it up and converting them all the way to funding is a long…drawn out… process. And here’s the dirty little secret that most lead gen companies don’t want you to know:

They have NO IDEA how to warm up your leads for you.

When you think about it, it makes sense why most lead generators don’t put in the extra work of warming up your leads. Once you buy leads from them, they’ve already made their money, so there’s no incentive for them to actually help you convert that lead into a deal.

All they have to do is deliver some names and basic contact information, cash your check and send you on your way. Meanwhile, you’re left doing all the hard work of cold calling those leads, trying to get them on the phone, gain their trust, and maybe – just maybe – get a client or two out of it.

Buying from basic lead generators is a broken model that leaves you tired, drained, frustrated, and fed up with internet leads as a whole. So you go back to the old strategy of chasing after realtors, stopping by open houses and buying them coffee, all in the hopes of getting some referrals.

Once again, then you’re left relying on realtors for business, which means that your realtor partners call all the shots and have way too much control over your business. So then you start again trying to buy junk leads and the vicious cycle repeats itself over and over.

But it doesn’t have to be that way.

There actually is a proven way for you to get viable, pre-qualified mortgage leads that have been warmed up FOR you, so you can grow your production exponentially (WITHOUT having to rely on realtors for business). This lead gen process outclasses the rest BY FAR and it’s literally going to help you grow your profits..

WHY IS IT SO SUCCESSFUL

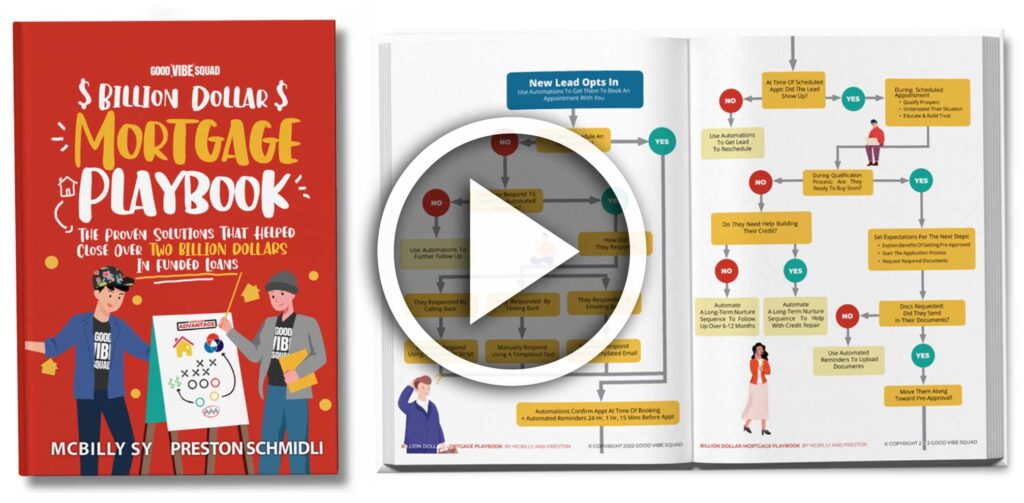

After helping 1,000+ loan officers and funding BILLIONS of dollars in loans directly from our marketing, we know what works (and what doesn’t work) when it comes to delivering high-quality mortgage leads to your business.

It all boils down to us running thousands of tests, countless trial-and-error, and pinpointing every crucial detail when it comes to generating high-quality, exclusive mortgage leads.

We know exactly what separates high-converting leads from the ones that just waste your time. And we want to pass these lessons onto you to help you in YOUR business. So let’s break down the RIGHT ways to generate warm leads for YOUR business

How To Generate Warm Mortgage Leads

What does it take to get a consistent stream of high-converting leads? (Hint: It starts with the ads)

To generate a good lead, you first have to grab their attention (IE advertise!).

But here’s the harsh truth about online advertising: It is NOT easy, cheap, simple, or fast. (If you’ve tried running your own ads in the past, you probably know that it’s a lot harder than it looks.)

As a loan officer, you CANNOT do all your own advertising and still be successful.

There is just not enough time in the day to be both an expert in mortgages AND marketing. We’ve literally seen this hundreds of times where people have tried to do both and have failed miserably.

Online advertising is not as simple as copying and pasting a template, plugging in some ad copy and hoping for the best.

It takes years of testing, thousands of hours of work, and millions of dollars to do advertising the RIGHT way. We know this for a fact, because we’ve done it.

The reality is that advertising is a full-time job. Here’s what it takes to run results-driven ad campaigns that actually convert:

We spend millions of dollars in managed advertising every year on advertising alone. But WHY do we spend so much? And what EXACTLY does that mean for you and your business?

Social media sites like Facebook want to make a lot of money, so whoever spends the most money on advertising is going to get the upper hand. When Facebook looks at an account that spends millions of dollars each year running ads, compared to an account that only spends a couple thousand dollars per year, which account do you think is going to get better targeting, more outreach, more traffic, and more leads?

Obviously, Facebook favors the higher-ticket ad accounts. (Also, if we ever need to get in contact with our Facebook rep, they answer our call before they get around to helping the independent ad account that only spends a thousand bucks a year.)

Another reason why our Millions of Dollars in annual ad spend gets you the best quality leads: Over the years, those millions of dollars in ad spend have helped us run thousands of tests, and aggregate massive amounts of data, resulting in a gigantic powerhouse when it comes to targeting your ideal customers, which are people who are looking to buy (or refinance) a home, and are actually likely to qualify.

Because writing, designing, and creating the ads is one thing… but getting the data to actually TARGET the right people comes with a whole other set of challenges. We’ve found that pinpointing the right targeting is pretty much impossible to do on your own with a couple thousand bucks to invest. You need a ton of time, money, and effort to get this right.

That’s why we invest so much of our hard-earned money into advertising each year. And fortunately it’s paid off exponentially for our clients!

So is that the whole secret formula? We just cut a giant check to Facebook and our ads instantly become the best? Haha, no. If only it were that easy…

Part of the reason why our ads work so well is because they resulted from us trying several variations over time, with multiple iterations of trial-and-error. Over the years, we’ve split tested different ads to pinpoint exactly which images, copy, and messaging works best to attract your ideal home buyers.

Also, keep in mind that all the money, hours, and manpower we’ve invested into our ads are specifically allocated towards the mortgage space. We didn’t spread our efforts among several different industries and finally settle on helping loan officers. We’ve literally spent millions of dollars, poured thousands of man hours and years of our lives into aggregating advertising data that’s specifically designed to help YOU get the highest quality, highest volume of MORTGAGE leads possible.

Now you know why good ads are so expensive, and why it’s so important to split-test those ads over time, what about the targeting?

Over the years, we’ve found the ad campaigns that work best are highly customized to the specific types of clients you love.

When our Ad Accounts Management Team creates your campaigns, they don’t just plug any old images and copy into your ads and press send. This wouldn’t work, because let’s say you’re licensed in California, and we use an image of a snow covered mountain home from Colorado. Do you think that picture is going to grab the attention of some Californian looking to buy a home? Probably not!

That’s why we make sure your ads are customized to your specific territories that you’re targeting. (Many of our clients are licensed and running ads in multiple states, so we take this into account as well when setting up their different campaigns.)

Not only do we customize your ads according to territory, we also customize your ads according to your types of prospects.

But what do we mean exactly by that?

We have several different niches that you can target, depending on your own specialties as a mortgage professional. For instance, let’s say you’re a veteran or part of a military family, and you specialize in VA loans. That means you already have a ton of momentum and know-how when serving your veteran clients, so we want to leverage that in your favor!

In this case, we set up ad campaigns that specifically target veterans or military personnel. So when you get these leads on the phone, you already have something in common with them and it’s much easier to build that connection.

In addition to veterans and military families, we have other niches to target your ideal prospects based on their occupation. These niches include: teachers and educators, healthcare professionals, first responders, government employees, and union members.

These types of campaigns work REALLY well at targeting your ideal clients. Because these groups are professionals, they’re more likely to have the income, credit, savings, and W2 required to qualify to buy a home! Also, you probably know someone in your family who’s a teacher, or a healthcare worker, or a first responder, etc. That means you can use that commonality to build rapport with that person, because you know firsthand what their specific needs are.

In addition to the niches listed above, we also have campaigns specific to first-time homebuyers. We found that a lot of mortgage professionals specialize in helping first timers get the guidance they need to navigate the home buying process, so we decided to create those campaigns to take advantage of that niche as well!

This all sounds great and all, but how do you know exactly which campaigns to leverage? It can be confusing trying to pick and choose which ad campaigns are right for your business. That’s why we have momentum coaches and training materials to cut through the confusion and help you decide which ad campaigns will work best for YOU (more on this later).

Earlier, we mentioned that we have an entire Ad Accounts Management Team to set up your ads, optimize your campaigns FOR you, so you get the best quality leads at the highest volume!

This is extremely valuable for 3 reasons.

First, if you’ve ever tried running Facebook ads on your own, you know that oftentimes, your ads will just get rejected (usually for no valid reason at all!). It’s a major headache to deal with on your own. That’s why it’s so awesome to have an Ad Accounts Management Team that notices as soon as an ad gets rejected, swoops in and resolves that issue with Facebook ASAP.

Second, we want to make sure you’re getting the highest ROI possible out of your ad spend. To deliver on that promise, our Ad Accounts Management Team is there to make sure these ads are performing at the best possible capacity, so that you get the highest volume possible of qualified leads.

Third, Facebook regulations are (unfortunately) always changing. Having an entire team of people to keep up with those changes is crucial. Whenever the Zucklord gets called into Congress, and a new compliance guideline has passed, then we have the manpower needed to quickly pivot our messaging and continue running ads that generate high volume, high quality leads.

Phew! Now you know A TON of information on advertising alone. Here’s a quick review:

- It takes millions of dollars worth of data, years of testing and thousands of work hours to create ads that actually CONVERT

- A huge component of online advertising is TARGETING, as in targeting clients in your specific territory, and going after specific professions or niches to make sure you’re connecting with qualified borrowers who can actually afford to buy a home

- Maintaining ad campaigns takes a lot of ongoing work and upgrades. That’s why we have an entire Ad Accounts Management Team dedicated solely to monitoring your ad campaigns for you

Awesome, so a prospective borrower clicks on your ad and they immediately become a lead, right?

Actually, no, there are SEVERAL steps in between a prospect clicking on an ad up until the point that they become a new lead in your pipeline. Let’s break down these next steps after the ad…

After The Ad: The Sales Funnel

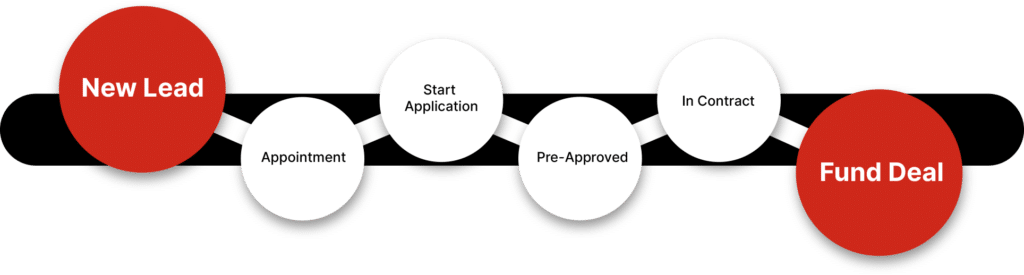

After the prospect clicks on an ad, they then pass through a multi-step sales funnel before they become a lead in your pipeline. This sales funnel consists of pre-qualifying filters, surveys, landing pages, and smart forms.

When prospect first enters the sales funnel, they must go through a series of surveys to pre-qualify them, making sure they have the desire, income, and credit needed to qualify. Similar to how our ads have resulted from years of split testing and trial-and-error, our pre-qualifying filters have also been tested and proven thousands of times over the years down to the smallest detail.

Every little factor that you might not think of (such as the overall design and flow, how to format each survey question, the sequence that each question appears, the verbiage used in each question and answers), every minor detail in our pre-qualifying surveys is highly intentional and tested over time.

Creating the best series of pre-qualifying surveys is a delicate balance. We don’t want to scare away the good leads with too much homework, but we also don’t want to make things too easy for low-intent leads to make it through to your pipeline.

Keep in mind, the surveys themselves are just one piece of this puzzle. The lead still has to opt in and consent to be contacted. At this step, we’ve found that it’s better to have them manually type in their contact info instead of using the auto-fill feature. This small detail filters out the low-intent prospects that aren’t serious about speaking with you.

The high-intent, pre qualified leads that make it through these filters then move on to a series of landing pages.

These landing pages include educational videos, along with personalized branding with your headshot and links to your reviews. These assets are incredibly powerful as they help to gain your leads’ trust and “warm” them up BEFORE the booked appointment. (This is an example of trust-based marketing.

Keep in mind that each landing page is customized for YOUR pipeline. Because it’s all highly customized to YOUR targeting, YOUR personal branding assets, and YOUR campaigns, we can’t just plug in the same surveys and sales funnels for every last client. We have to personalize each sequence to best suit YOUR account.

Once we set all that up for you, our team still needs to monitor and optimize your sales funnel performance to ensure you’re getting the best quality leads and the highest volume possible.

That’s why we integrate smart forms into your sales funnels. Smart forms are a tracking feature that allow us to see how leads interact with your pages. For instance, if we notice a high volume of leads drop off at a certain part in the survey, this may indicate that the verbiage is too “wordy” and it loses their attention. This tracking helps us make tweaks to optimize your sales funnel performance.

Sounds complicated, right?

It sure is!

But the good news is that we have multiple teams of awesome people working together to take care of all this FOR you! It all falls into place to take the tedious lead generation off your plate so you can focus on what you do best, which is originating loans and building relationships!

So now you know about ALL the steps it takes to generate a high-quality mortgage lead, but HOW do you actually get that lead to the booked appointment?

Done-For-You Appointment Booking

After we generate a pre-qualified mortgage lead for you (and warm them up through our proven sales funnel), we then get that lead to self-book appointments in your calendar! Here’s how it works:

Once a pre-qualified mortgage lead passes through our series of sales funnels, they’re then taken to a calendar scheduling page, where they can actually self-book an appointment with you! This feature is an absolute game changer for our clients. Imagine waking up each morning to a calendar full of booked appointments, all with pre-qualified mortgage leads who have already opted in and given you their PERMISSION to call them!

(Not to mention, they’ve offered up a ton of info for you to review before the call, so you can quickly get a clearer picture of their circumstances before speaking with them.)

Based on our client feedback, that appointment booking feature alone takes massive amounts of stress off their plate AND frees up several hours of extra time each week!

But how does it work?

We’ve built out a calendar booking system as part of our software that allows leads to self-book appointments with you. When you first onboard with us, we’ll help you sync your work calendar to our appointment booking system. Then our team takes care of the rest!

So WHAT IF you have an awesome new lead, but they didn’t book an appointment with you?

This definitely happens from time to time. A pre-qualified lead passes through the series of funnels but still doesn’t book an appointment with you. In that case, you don’t just lose the lead. They simply become a new lead in your pipeline, right before the booked appointment stage.

These new leads will be receiving new lead specific automated follow-ups from our system to keep them interested. Plus, you’ll ALSO have their contact info so you can manually reach out to get them scheduled in your calendar. That way you don’t miss out on the opportunity just because they weren’t quite ready to move forward with the appointment booking.

As you can see, every step of our sales process is highly intentional and optimized to help you fund more deals than ever while saving hours and hours of time. But this is just the beginning!

Want to learn how we can get you high-quality leads among many other awesome benefits from our marketing?

Book your free growth strategy call to get your custom action plan for more leads and deals immediately! It’s the most valuable 10 minutes you’ll spend on your business this year.

Transform Your Business With Results-Driven Lead Gen.

Leverage Leads To Save Time, Boost Referrals, and Grow Exponentially

Why You Should Delegate Your Home Loan Lead Generation

The Top Producer’s Secret To Working Smarter – NOT Harder

Generating pre-qualified, exclusive mortgage leads requires a massive amount of time, money, and effort. If you’ve tried generating leads on your own, you know firsthand how difficult this can be. Even if you managed to get some results from doing your own lead gen, you probably didn’t reach the level of success your were hoping for.

The harsh reality is that there’s just not enough time in the day to be both a lead gen expert AND a mortgage expert. People who try doing it all on their own end up being mediocre across the board, rather than sticking to their “zone of genius.” But when you delegate your lead generation, this allows you to stop wasting your time chasing after leads, and instead focus on what YOU do best, which is originate loans and build relationships.

This shift in focus sets off an upward momentum that really allows you to scale your business – while creating more free time for what matters most. Imagine if every ounce of work you put into your business translated directly into more funded deals and more PROFIT in your bank account. That’s exactly what you get when you partner with Good Vibe Squad.

Here’s how we help loan officers work smarter not harder:

Results-Driven Marketing

We’ve helped over 1000+ loan officers reach massive success. Our mortgage growth process is proven to work for solo producers, branch managers, mortgage brokers, and loan originators. Whatever the market, whatever the territory, our ads and lead gen are going to help you WIN.

All-Inclusive Automations

Our proprietary mortgage growth CRM comes with 80+ automated campaigns to account for ever last scenario that can come up. No more chasing after leads trying to book them in your calendar, no more wasting time trying to get people to send in their documents. It’s the fastest, easiest way to streamline your lead-to-client journey and speed up your sales process.

World-Class

Support

Most loan officers are blown away by the level of support we provide. When you partner with Good Vibe Squad, you get a full Member Success Team to ensure you’re focusing all your energy on activities that directly generate revenue (rather than getting caught up in side quests that waste your time).

How To Keep Your Lead Gen Compliant

Stay Within All Legal Guidelines And Mortgage-Specific Protocols

We’ve been highly involved in the vendor approval and compliance process, working with dozens of mortgage companies that we’ve been vendor approved with.

We take compliance EXTREMELY seriously to make sure that the service that we provide, everything we do is top-notch quality within the law. We want to make certain that we’re within TCPA compliance, Can-Spam compliance, and that we’re following all of the mortgage-specific protocols.

We’ve mentioned that our Ad Accounts Management Team is there to tweak, pivot, and adapt our messaging any time a new compliance guideline has passed. They’re incredible at what they do, making sure your ads run at their peak performance while also remaining 100% compliant and kosher within all the updated legal guidelines.

But because compliance is such a serious matter, we decided to double down and hire a Chief Information Securities Officer (CISO), whose sole job is to handle any legal or compliance related questions or concerns that come up.

Our CISO is great to have on our team because we want to make certain that we’re never operating within the “gray area” of the regulations. To us, the “gray area” is far too risky and goes against our integrity as a company.

Over the years, we’ve found that dealing with compliance is often a case-by-case basis. There are legal requirements and there’s company compliance.

We always strive to fulfill the requirements of the law. But sometimes mortgage companies want to make sure that they’re involved and they know what’s really going on. Having a CISO on our team to navigate those issues makes those communications run a lot more smoothly.

If at any point, you have any compliance or vendor approval issues (maybe you decide down the road to change companies and the new company wants to give you grief over whatever issue), you can easily reach out to us for help. Having a CISO on our team makes all those case-by-case questions and concerns 100% easier to resolve. That way, we can make sure that we’re providing a fantastic experience for you and for your own compliance teams.

How Much Does Mortgage Lead Generation Cost?

Maximize Your ROI For Every Dollar Of Ad Spend

There are several different marketing tactics you can use to “generate leads” such as social media marketing, mailers, print ads, radio, community outreach, event sponsorships, and even hosting Lunch N’ Learns or live classes. The problem with these marketing tactics is that there’s a lot of work (input) required and no measurable way to predict the results (output) from your investment.

Unlike those other mortgage lead generation strategies, our results-driven process has been fine-tuned over the years, tested and proven to yield a predictable source of income. That output in terms of your loan volume is directly correlated with how much you invest into your ad spend.

Think of your ad spend as a faucet: It allows you to control your lead volume just like how a faucet controls your water pressure. The more money you invest into your ad spend, the more leads will flow into your pipeline.

Depending on the volume of leads you’re looking for, your ad spend will vary. You may want to start small, stick with the $1,000 monthly ad spend minimum. Then as you get more comfortable with the high volume of leads coming in, you may decide to put more gas in the tank and amp up your production even more!

This ad spend also gives you more flexibility, so if you decide to grow your team and add on more originators to keep up with production, you can then raise your ad spend to keep your team busy with a steady flow of high volume leads!

So WHY do we require a monthly minimum ad spend of $1,000 in our main service plan?

Just so you know, your ad spend does NOT go into our pockets. We do not make more or less money depending on how much you allocate toward advertising. We require this $1,000 monthly ad spend minimum simply because it is in our best interest for YOU to succeed and maximize your profits from our marketing.

After working with 1000+ of loan officers over the years, we’ve found that some clients made the mistake of investing as little as possible into their ad spend.

But this is NOT the mindset we want for you when investing in our service. It’s a “penny rich, dollar poor” mentality. The way social media ads work, just investing a couple hundred dollars into ads doesn’t really pay off.

The advertising reach you get for a few hundred dollars is comparable to the same reach you’d get with a measly 50 bucks. At that level, why spend anything on ads at all?

But the $1,000 mark is the “tipping point” where your investment really takes off in terms of advertising power and audience reach, because this is the point where the social media algorithm really starts to work more in your favor.

In fact, for our clients who have assistants or a small team that can handle the lead volume, we actually encourage them to spend as much as possible on advertising if they seriously want to amp up their production.

It’s not a question of whether or not that ad spend will pay off, it’s a question of whether or not their team can keep up with that high volume of production.

To summarize, because we’ve already pre-built a predictable, results-driven lead generation process, working with Good Vibe Squad means you can predict your income (output) according to the amount of money you invest (input) into your ad spend.

Award-winning mortgage marketing agency

Award-winning mortgage marketing agency

Awarded by Inc Magazine to their prestigious Power Partner awards and have been featured in these publications:

Good Vibe Squad's Results-Driven Lead Gen

Get The Best Quality Mortgage Leads At The Highest Volume

Ads Backed By $2M+ In Data

Stop wasting time trying to run your own ads, or paying small-time advertisers for junk leads. Unlike other lead generators, our ads are backed by $2M+ in data, with a full Ad Accounts Management Team to constantly optimize your campaign performance and ensure you get the best quality leads at the highest volume.

Trust-Building Sales Funnels

Not only do we pre-qualify your leads to make sure they have the desire, income, and credit needed to buy (or refinance) a home, we ALSO push them through a multi-step sales funnels to gain their trust and warm up your leads before they even speak to you.

Done-For-You Appointment Booking

Wake up each morning to a calendar full of booked appointments, all with pre-qualified, exclusive mortgage leads who have opted in and want YOUR help getting into a home. No more wasting time chasing after leads ever again!