Mortgage CRM & Automations

Best Practices For Using Automations In Your Mortgage Business

The Most Efficient Ways To Maximize Profits From Your Mortgage CRM

As a loan officer, your automated CRM is your vehicle to a successful mortgage business. And while you don’t need to know EVERY last detail that goes on under the hood, you should know the best practices for operating your CRM, so you can really maximize your results from this system.

Most mortgage professionals have some form of automations in their business, but the harsh reality is that not all automations are created equal.

After working side-by-side with 1000+ of mortgage professionals over the years, flying out to their offices and seeing firsthand what loan officers deal with on a daily basis, we found that most mortgage CRMs are riddled with problems. This is a serious issue, because working with a defective CRM is like driving with a flat tire – it can seriously hold you back from getting you where you want to go.

To solve for these problems, we created our own proprietary mortgage growth software called Loan More CRM.

Loan More CRM is a results-driven growth machine for mortgage professionals. This software has resulted from years of research and testing, multiple teams of people working together to build, maintain, and constantly upgrade the software brick-by-brick. Combined with our mortgage marketing process, Loan More CRM has helped our clients to Billions of Dollars in funded loans!

But don’t just take it from us. Here are some actual quotes from mortgage professionals who have used Loan More CRM in their business:

Whether or not you decide to use Loan More CRM in your business, we want to fill you in on everything you need to know about mortgage CRMs and automations. Throughout this page, we’ll break down all the features that go into a powerful mortgage CRM (that actually gets you results), along with the best practices that you should follow on a daily basis, so you can maximize your profits while freeing up more time for what matters most.

The Problems: Why do most mortgage CRMs miss the mark?

Why most automations fall short – and how you can vault over those hurdles to come out on top

There are a lot of shortcomings in the world of automations and sales CRMs.

First, they don’t have the resources needed to keep up with the changing times. Consumers are constantly getting smarter. It’s easier than ever for your prospects to know the difference between an automated message vs a personal one. That’s why it’s crucial to keep your automations up-to-date so you can stay ahead of the curve.

Second, many CRMs are designed as a one-size-fits-all template. These automations are supposed to serve all types of industries – NOT just the mortgage space. But as you know, the mortgage sales process is vastly different from insurance, technology, finance, or any other type of industry.

Third, many systems require far too much DIY work. You’re supposed to go in and customize your own follow-ups and campaigns, but what mortgage professional has the time and energy for all that extra work?

Fourth, they don’t strike a perfect balance between automated VS manual outreach. They either try to automate TOO much, which makes it impossible for you to build personal connections with your clients. Or, they don’t automate enough, which leaves you wasting time trying to keep up with tedious follow-ups.

Let’s break down what these CRM shortcomings mean for YOUR business, and how you can solve for them.

A common problem with other automated systems out there is that they just don’t have the resources to maintain and upgrade those campaigns over time. But the reality is that automated campaigns are not simply “set it and forget it” feature. You could have the most well-built machine in the world, but that machine is still going to need a lot of maintenance, upgrades, and optimization over time.

That’s why we have in-house, dedicated Automations Specialists to ensure our campaigns keep running smoothly without missing a beat. Keep in mind, we’re always striving to grow, enhance, upgrade, and improve our systems. Our Automations Specialists work with us to upgrade our software behind the scenes, while making sure everything continues chugging along smoothly on YOUR end.

Unfortunately, a lot of loan officers are working with “general use” CRMs. These automations are a basic template to be used across multiple industries – NOT just the mortgage space. Because these “general use” CRM companies don’t specialize in helping mortgage professionals, their campaigns tend to fall short.

For most people, buying a home is the single largest purchase they’ll ever make. Plus the homebuying process itself can get incredibly stressful and overwhelming. That’s why the verbiage in your automations is SO important (and should be written by a team that actually understands the homebuying process). The messaging should be designed to relieve your prospects’ stress and get them excited move forward with you (while ALSO remaining 100% compliant within all legal regulations and mortgage protocols).

In addition to having messaging specific to the mortgage space, every tiny detail such as pipeline layout, tracking, even the timing of WHEN automations are sent out to your prospects, all those nuanced details have to be specifically tailored to the mortgage sales process.

Not to mention, the turnaround time for mortgage closings is unlike any other industry. It might take as little as 1 month, or it could take up to 2 years before you convert a lead into a borrower! That’s why having multiple types of campaigns to account for these different timelines is crucial for growing your loan volume.

You do have the option to try a “general use” CRM then go in and customize your automations on your own time. Unfortunately, building out a powerful, results-driven mortgage CRM takes massive amounts of effort. That’s why we’ve had multiple teams of people working together over the years to build out Loan More CRM to what it is today. Trying to go in and do your own automations ON TOP OF running your mortgage business… that’s like trying to do 50+ jobs at once.

There’s just not enough time in the day to be both a mortgage expert AND an automations expert. What we’ve found is that loan officers who try doing it all on their own end up being mediocre across the board. They get completely burnt out and frustrated, without ever reaching the level of success they worked so hard for.

Hybrid Automation is the perfect blend of automations + manual actions. You want to automate as much as possible to save you time. However, you also want to leave room for personal touches (IE manual actions) to help you build strong relationships with your clients.

For example, let’s say you need to go see a doctor. You schedule an appointment with the receptionist, they take down your insurance info, then a nurse takes your vital signs, and finally you speak to the doctor for a a max of 15-30 minutes.

With a Hybrid Automation system, the receptionist and nurse are like the automated follow-ups, meanwhile you yourself are the doctor. Instead of wasting time on lower-level activities like booking appointments or taking down basic info, you put all your time toward higher-level activities that actually require your EXPERTISE as a mortgage professional.

Certain types of follow-ups are easier to automate because the goal is simply to grab your lead’s attention, retain their attention, and keep your name fresh on that lead’s mind. But with other interactions, it’s important for you to step up to the plate and be the trusted mortgage advisor. (This is the personal connection piece that leads to more client referrals and refinance deals down the road.)

With Loan More CRM’s Hybrid Automation system, we take all the tedious, time-wasting follow-ups off your plate. That way you can focus all your time and energy on the higher-level activities, such as building relationships and originating loans.

It all comes down to having both quantity AND quality of automations.

As a loan officer, you need to have follow-up systems in place for ANY scenario that could come up. That’s why we’ve packed Loan More CRM with 80+ campaigns to have you covered. For example, if someone misses an appointment with you, we have automations in place to get them to reschedule. If a lead seems to have ghosted you, we have automations to get them back on track and engaged in a conversation.

But what about those people who need a bit more time? Just because someone isn’t quite ready to buy or refinance until a few months from now, doesn’t mean we should throw that opportunity away!

For this reason, we ALSO have long-term follow-up campaigns for those borrowers who need a bit more time. These long-term follow-ups are absolutely proven to get you more purchase and refinance Deals 3, 6, or 12 months down the line!

Loan More CRM accounts for all the different scenarios that can come up, from the time a borrower first enters your pipeline all the way until they become a closed loan. But the automations don’t stop once the deal is funded! In fact, we even have post-sale automated follow-ups in place that will reach out to your past clients, helping you to rake in more 5-star reviews, customer referrals, and future refinance deals!

But in addition to having a high QUANTITY of follow-up campaigns, you also want to make sure those campaigns are written and designed with the utmost QUALITY. That’s why the wording we use in our messaging is highly intentional and conversational. This keeps leads interested WITHOUT coming on too strong. Frankly, a lot of other automations out there aren’t written very well, so their follow-ups read like robo-texts, which can easily scare away your borrowers.

Loan More CRM also includes TONS of educational resources, articles, videos, and PDF guides to help your prospects along their home buying or refinance journey. These educational resources are absolutely proven to build trust and establish yourself as the expert in your field.

Having high-quality automations to quickly catch your prospects’ attention and move them along toward pre-approval and funding is extremely important. That’s what separates Loan More CRM from the other systems out there that miss the mark.

Mastering Hybrid Automation: Manual VS Automated Follow-Ups

When should you let the automations do the work, and when should you step in to follow up manually?

Hybrid Automation is the perfect blend of automations + manual actions. You want to automate as much as possible to save you time. However, you also want to leave room for personal touches (IE manual actions) to help you build strong relationships with your clients.

Loan More CRM includes 80+ automated campaigns that save you hours of time and take all the tedious follow-ups off your plate. But even the best automations in the world cannot just originate loans for you.

Knowing when to let the automations do the work, vs knowing when to step in and manage your pipeline is crucial to building strong relationships with your clients.

To help you better understand the perfect balance between automated vs manual actions, we’ve broken it down for you below:

When Should You Let Automations Take Over?

Automations are great for all the tedious, time-consuming follow-ups that don’t necessarily require mortgage expertise. Here are some examples:

Catching & retaining the lead’s attention on the front end

Booking appointments

Sending out appointment reminders

Reminding leads to send in required documents

Long-term nurture follow-up campaigns

Post-sale follow-ups for 5 star reviews and refinance deals

The powerful thing about automations is they keep working for you 24/7 even when you’re away from your desk. That way, you can enjoy your personal life, spend time with friends and family, without worrying about a potential borrower slipping through the cracks.

Throughout this page, we’ll break down these automated follow-ups in more detail, so you can clearly picture what it’s like to use these types of automated campaigns in your mortgage business.

When Should You Manually Follow Up?

No amount of automations can act as a trusted mortgage advisor who takes the time to understand the client’s needs and guide them into a better future. That’s where you step in.

So while Loan More CRM takes the bulk of the tedious follow-ups off your plate, we still encourage our clients to manually reach out to their leads to build relationships. These manual follow ups include:

Showing up on booked appointments

Taking applications over the phone (using our proven phone framework)

Following up with new leads to get them to the application stage

Responding when leads have questions or need your guidance

In addition to building personal relationships with your leads, there’s another reason why we encourage you to do some of these manual follow-ups…

It’s because timing is CRUCIAL. If you have some free time where you’re available to hop on a phone call with someone who needs your help, by all means you should take advantage of that time window and try to get your leads on the phone.

We’ve seen this work countless times: A loan officer will have an open time window, so they just happen to follow up with some new leads in their pipeline, and lo and behold, they’re able to catch that lead at the perfect time, connect over the phone, take an application, and it eventually results in a funded deal.

So yes, our automations are 100% proven to save you hours and hours of time. But keep in mind that these automations are designed to take all the tedious, LOW-LEVEL activities off your plate.

That gives YOU more free time and energy for the high-level, revenue-generating activities for your business, such as building relationships with clients, acting as their trusted mortgage advisor, and originating loans.

Done-For-You Appointment Booking

Get Warm Mortgage Leads Delivered Straight To Your Pipeline

The time it takes to generate an exclusive mortgage lead, pre-qualify them, warm them up, and get them to the booked appointment…that alone takes a massive amount of time and effort. And it’s really not reasonable to expect you to do that on your own.

But the great thing about working with Good Vibe Squad is that we do a lot of this work FOR you. First, we generate exclusive mortgage leads FOR you, pre-qualify them, then push them through a series of trust-building funnels to “warm” the leads up. (To learn more about our done-for-you mortgage lead generation, click here.)

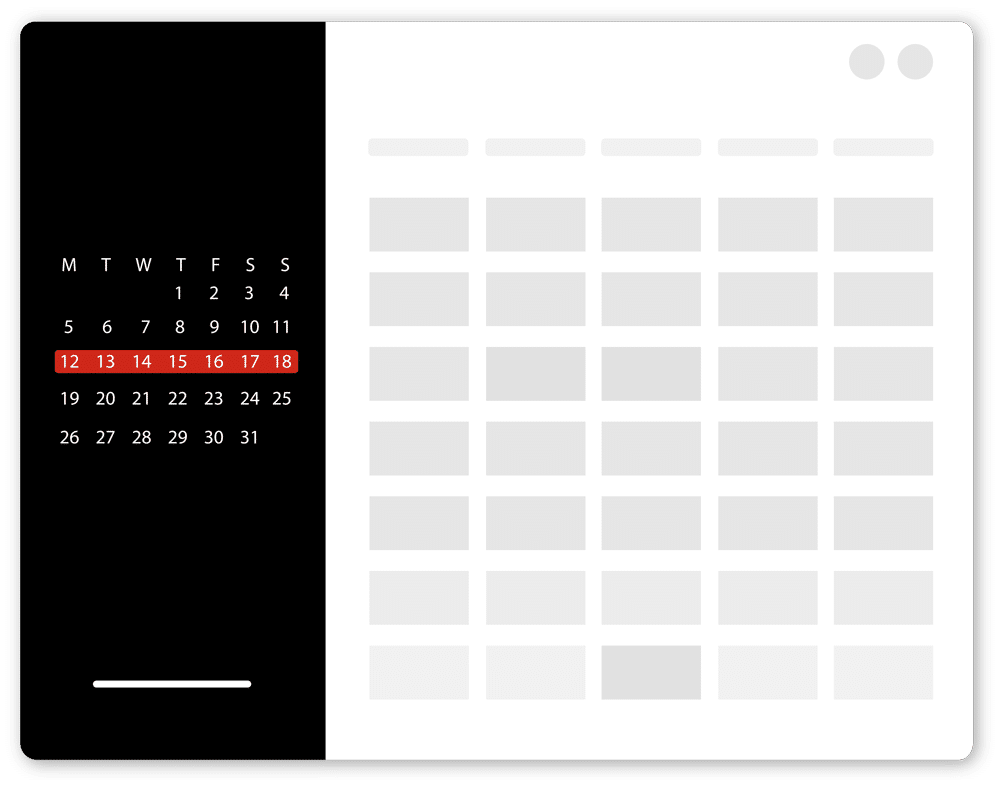

Once a pre-qualified mortgage lead passes through our series of sales funnels, they’re then taken to a calendar scheduling page, where they can actually self-book an appointment with you! We’ve built out a calendar booking system as part of our software that allows leads to schedule appointments directly in your calendar. (When you first onboard with us, we’ll help you sync your work calendar to our appointment booking system.)

Imagine waking up each morning to a calendar full of booked appointments, all with pre-qualified mortgage leads who have already opted in and given you their PERMISSION to call them – that’s exactly what you get when you partner with Good Vibe Squad!

Based on our client feedback, that appointment booking feature alone takes massive amounts of stress off their plate AND frees up several hours of extra time each week.

But WHAT IF you have an awesome new lead, but they just weren’t quite ready to book an appointment with you?

This happens from time to time. A pre-qualified lead passes through the series of funnels but still doesn’t book an appointment with you. In that case, you don’t just lose the lead. They simply become a “New Lead” in your pipeline, right before the “Booked Appointment” stage.

These New Leads will be receiving New Lead-specific automated follow-ups from our system to keep them interested. Plus, you’ll ALSO have their contact info so you can manually reach out to get them scheduled in your calendar. That way you don’t miss out on the opportunity just because they weren’t quite ready to move forward with the appointment booking.

Done-for-you appointment booking sounds great and all, but here’s the BIG PROBLEM that we’ve seen with other mortgage CRMs:

They might help you get the lead to the booked appointment, but then you are completely on your own. You have to do all the hard work of staying in touch with that lead, nurturing the relationship, until you FINALLY convert them to a closed loan.

To solve for that problem, Loan More CRM has automated follow-ups that account for all the different scenarios that can come up, from the time a borrower first enters your pipeline, all the way up until the funded loan – and beyond!

Complete Lead-To-Client Journey Automation

Never Let Another Borrower Slip Away. Leverage Every Last Opportunity While Freeing Up Time.

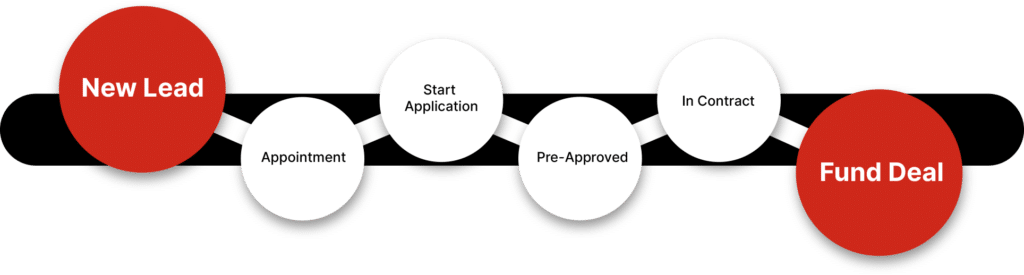

The second a prospect enters their information, that prospect automatically enters your pipeline as a “New Lead.” We want to “catch” that lead while they’re still interested in getting your help, so we have New Lead-specific campaigns that automatically send out SMS texts, emails, and voicemail drops to keep that lead’s attention.

For leads who book appointments with you, we have Booked Appointment-specific campaigns that send out email and text reminders leading up to the scheduled appointment. These reminders go out 24 hours, 1 hour, and 15 mins before each meeting. Some might say all those reminders are too heavy-handed, but we’ve done the research and found that you HAVE to be that persistent in reminding people to show up! People live such hectic, busy lives nowadays that it’s easier than ever to get distracted.

Also, keep in mind that until a lead has a person-to-person conversation with you, they’re much more likely to forget about you and ghost you because they don’t yet see you as a real human being. That’s why being so heavy-handed with the reminders and follow-ups on the front end is important for keeping a lead’s attention until they speak to you.

But what if a lead books an appointment with you, then for whatever reason doesn’t show up to the booked appointment? Hey, it happens from time to time, but that doesn’t mean you should give up on that prospect! That’s why we have No Show-specific campaigns that automatically follow up with the lead to get them to reschedule.

Now let’s say you have the Booked Appointment and good news, you were able to take the application! In that case, the lead is now in the Docs Requested stage, meaning they need to submit all the required documents before you can get them pre-approved. We’ve found that oftentimes, leads forget to send in documents and next thing you know you never hear from them again. That’s why we have Docs Requested-specific campaigns that automatically remind these leads to send in the required documents before they forget altogether.

These automated campaigns help speed up the process from New Lead all the way to the Funded Loan, reminding your leads to stay on track and focused on the finish line, which is closing on their home loan.

It’s great having these automations working for you 24/7, because you don’t have to worry about human error or anyone getting distracted and forgetting to take the next step. You also don’t have to waste your time or energy chasing docs or trying to get new leads booked in your calendar.

But these follow-ups are just the tip of the iceberg. In fact, Loan More CRM is packed with over 80+ automated campaigns to streamline every step of your lead-to-client journey. It all comes together to take the tedious, time consuming tasks off your plate so you can focus on what YOU do best: building relationships and originating loans.

But it doesn’t stop there…

Long-Term Nurture Campaigns

How To Hold Onto Opportunities When Leads Aren’t Quite Ready To Buy

One of the #1 qualities that separates top producers from the average originator: being long-term focused. The reality is that not every lead you talk to is going to be ready to buy right now. But if you’re able to preserve that relationship with a lead, then that could result in a BIG payday 6-12 months from now!

The problem is HOW do you hold onto that opportunity? How do you keep your name fresh on that lead’s mind without coming off too pushy?

Not to mention, you already have so much on your plate, remembering to follow up with someone periodically over the course of a year just is not realistic…

So what if you have an awesome lead, they have the desire to buy a home, they’re likely to qualify in the near future, but they just won’t be quite ready to move forward until 3, 6, or 12 months from now? In that case, just plug them into Loan More’s Not Yet Ready-specific campaigns to keep in touch with the lead over a long period of time.

These campaigns check in with the lead periodically over the course of 3-12 months, keeping your name fresh on that lead’s mind, and sending out educational materials to help them along their journey. These campaigns are absolutely PROVEN to pay off in the long run. It’s incredibly valuable to have a system that holds onto these opportunities FOR you so you don’t have to keep setting reminders for yourself to try to keep in contact with those people.

“If you’re in it for the long term game, then Loan More CRM is set up really well to help stay in communication with your opportunities. I can think of a client named Brandon, we had put him a long term nurture campaign and he called us back and said ‘You were the most persistent without being pushy, so we knew once we were ready, we HAD to go with you!'” Amanda L. Want to use long-term nurture in YOUR mortgage business? Click the button below for a free call!

Reputation Management & Referral Campaigns

More Clients + 5-Star Reviews + Client Referrals = Exponential Growth!

You know when a video or meme goes viral? One person shares it to 2 friends, and those 2 friends share to 2 other friends each, and so on and so on until pretty soon millions of people are laughing at the same cat meme? That’s how we want you to think about growing your mortgage business!

Loan More CRM isn’t created just to help you add a couple extra deals each month – it’s designed to help your business go VIRAL!

Combined with our done-for-you marketing, Loan More CRM helps you grow your existing client base, then gets you more 5-star reviews to build up your authority, and leverage client referrals to help you turn 1 funded loan into 3-5 opportunities over the long term.

As soon as your happy client closes on their home (or refinance), we definitely want to reach out to them to ask for a 5-star review!

Problem is, having to keep up with this on your own, manually follow up with your clients to ask for a review, and then manually remind them 2 or 3 times in case they forget, it’s just a tedious process that takes your time and energy away from higher-level activities.

That’s why we’ve systematized an automated follow-up process already done FOR you! After closing on their home, these automated campaigns will reach out to your clients on your behalf asking them to review you. (Plus these campaigns will also remind your clients a couple more times in case they forget.)

Similar to our other campaigns, the messaging in these follow-ups are highly intentional. It’s not as simple as “Hey please write me a review, here’s the link.” We actually use tested and proven sales strategies to persuade your client to take action and write you that 5-star review!

But here’s a potential hiccup: WHAT IF, for whatever reason, a client had a less-than-excellent experience? Are they going to post a bad review onto your business pages?

We already have a built-in solution for that! In the (rare) event that a borrower has a bad experience, this campaign will actually filter that negative feedback out! You’ll still receive the review privately so you can learn from that feedback, but it won’t be publicly posted online.

Getting more 5-star reviews from our automations is great and all, but what about client referrals?

When one of your clients refers you to their friend or family member, it’s actually really easy to add that new referral lead to your pipeline! And here’s the awesome part about that, we have client referral-specific campaigns that will reach out to that referral lead on your behalf!

Whether this referral lead is looking to purchase or refinance, we have separate campaigns to account for both scenarios. All you have to do is take 20 seconds to plug in their name and contact info into your pipeline, and then just let the system do the rest of the work for you!

Want to make your mortgage business go viral? Click the link below to learn more!

Soft Phone + Power Dialer With Call Recording

Call leads from your desktop, laptop, or mobile device. Power dialer feature to quickly & efficiently call leads one after the other, with an automated call recording feature.

LoanMore CRM’s softphone feature allows you to call your prospects and clients from your desktop, laptop, or mobile device using an internet connection.

What’s so valuable about this softphone feature is that you don’t need cell service to use it, and it automatically records your calls without you even having to think about it. Our clients have found this automatic call recording feature extremely useful, because they can always go back and listen to a recording if they need a refresher, or if they just want to fine-tune their phone skills.

Now you may be wondering, WHAT in the world is a power dialer? Let’s say you have 50+ leads that you want to follow up with. The old way, you’d have to dial each and every phone number, then if the lead doesn’t answer, manually leave a voicemail and/or text, and after each call, you’d punch in the next phone number and do it all over again 49 more times. Not only is that incredibly time consuming, but it’s a boring, inefficient process that makes it all too easy for you to get distracted.

Manually following up with a long list of leads is like playing 18 holes of golf on foot. You have to walk up to each hole, it’s tiring, it’s time consuming, and it takes your focus and energy away from your swing.

The power dialer, on the other hand, is like your golf cart. It saves you time, it saves you energy, and it helps you play better.

Here’s how it works:

Let’s say you want to follow up with that same list of 50+ leads, but this time you’re using the power dialer. You start the power dialer, and it quickly calls the first lead on the list (without you having to painstakingly punch in the numbers). If the lead doesn’t pick up, then all you have to do is drop a pre-recorded voicemail message (this is all set up for you ahead of time during your onboarding), then send a quick text using one of our pre-built text templates. It literally takes about 10 seconds and just a couple clicks! The power dialer will then move on to the next lead in your list.

And when a lead DOES pick up the phone, go ahead and proceed with the call, you can easily take notes and save them to that lead’s profile. And once you finish up that call, just move onto the next lead on your list!

The power dialer takes all the hassle out of your phone follow-ups, making the process faster, more efficient, and more rewarding!

We want to be completely open and transparent with you on this: a lot of our newer clients don’t realize the power of power dialing until they actually SEE it in action. And sure, it does seem complicated at first (as does every new skill when you’ve never done it before).

But the great thing about it though is that all the power dialer tools are already programmed FOR you during your initial set-up. You will record your voicemails ahead of time (we actually GIVE you voicemail scripts to follow), and our Onboarding Team programs these pre-recorded voicemails into your system. All the text templates, note taking, lead profiles will be laid out for you, so no need to worry about adding those in.

When it comes to showing you exactly HOW to power dial, our Member Success Team is happy to hop on a call and walk you through this. Plus they’ll also fill you in on the best practices for power dialing so you can maximize your results!

Once you integrate the power dialer into your daily workflow, you’ll be taking more applications, catching more interested borrowers faster than ever, and ultimately closing loads more in funded deals!

Lead Source Integration

Combine all your lead sources into one easy-to-use CRM

We LOVE taking the marketing gruntwork off your hands, generating high-quality, high-volume leads 100% done for you so you never have to stress over finding leads ever again!

However, we never want you to miss out on an opportunity to fund more loans. Even if that opportunity didn’t come directly from us.

If you have other lead sources that are working for you (It’s okay if you are – we’re not the jealous type!), whether they’re from referral partners, Zillow, BankRate, Realtor.com, LendingTree, your own personal websites or Google search ranking, we don’t want you to have to waste time switching back and forth between different platforms.

That would be a huge headache trying to keep track of multiple pipelines. You already have enough on your plate to think about on a daily basis, so let’s simplify that process and make your workdays easy as pie.

Our proprietary software allows you to seamlessly integrate all your lead sources into one CRM.

Let’s say you get some awesome leads from a lead generator, but you don’t have an easy way to keep track of or follow up with those opportunities.

Simply add that lead source into your LoanMore CRM, and our 80+ automated follow-up campaigns will take it from there!

Because at the end of the day, it doesn’t matter where you get the new business from. As long as you’re helping more families, closing more deals, and freeing up more time for what matters most.

Are you ready to stop tearing your hair out trying to manage your pipeline? Want a fast, stress-free solution for growing your loan volume? Click the link below to get started!

Full Setup Of Custom-Built CRM System With Proven Scripts

Our Fulfillment Team custom builds your CRM system, complete with templates, campaigns, and automations so you can save time while managing your pipeline with utmost efficiency.

Whenever a new client joins up with us, we can’t just slap their name on a system and have it up and running in an instant. Any system like that isn’t the best solution for you.

The way Loan More CRM works, you have to custom build it for each client on a case-by-case basis to avoid any errors or bugs that would come up if we were to just hand everyone a copy-paste template.

It’s like building a car. You can’t just put it together at the click of a button! There are countless moving parts, systems, and testing to be done before it leaves the factory.

To make sure your CRM runs smoothly, the Fulfillment Team has to program the campaigns, adding in the automated follow-ups, templates, testing the softphone feature and power dialer, making sure the text and emails run properly.

Plus, we have to customize your campaigns, ads, branding assets, review links, and client profile specific to your account. There’s the programming that takes place where we build out the done-for-you marketing process, and integrate it to your automated CRM so everything works together in tandem.

This full set up process takes a lot of effort, attention to detail, and testing. Luckily, we have a dedicated Fulfillment Team and an Onboarding Team to take care of this process for you! They are incredible at what they do, making sure you get the best quality CRM system so you can manage your pipeline with the utmost efficiency.

Transform Your Business With Loan More CRM

Get Exponential Growth & Profits For Years To Come

With Loan More CRM, the possibilities are endless. It’s the fastest way to win more deals, grow your referrals, lock down exponential growth for years to come, all while creating more free time for what matters most.

Doesn’t matter the market, changing rates or inventory, with Loan More CRM you are going to grow your business without having to stress over changes in the housing market.

Here are just some of the features you get when using Loan More CRM in your business:

Done-For-You Appointment Booking

No more chasing after leads trying to get them to the booked appointment. Wake up to a calendar full of appointments all with pre-qualified mortgage leads who want YOUR help buying a home.

All-Inclusive Automations

From catching new leads, sending out reminders, following up on docs, long-term nurture campaigns, and so much more, Loan More CRM takes ALL the tedious, time-wasting follow-ups off your plate so you can focus on generating revenue (and enjoying your personal life!)

Realtor Partner Attraction Campaigns

Loan More CRM automatically follows up with prospective realtor partners on your behalf! Quickly build new relationships with real estate agents, while automatically tracking how many deals each realtor sends your way.

Boost 5-Star Reviews & Client Referrals

Make your mortgage business go viral like it’s the latest cat meme! Leverage each and every opportunity to turn 1 funded loan into 3-5 more deals down the road – all without having to waste time asking for reviews or chasing after referrals.

Dedicated Automations Specialists

In-house, dedicated Automations Specialists to ensure your campaigns never miss a beat. Our Automations Specialists constantly upgrade our software behind the scenes, while making sure everything continues chugging along smoothly on YOUR end.

Top-Notch Service & Support

A full Member Success Team of awesome, real-life people who have your back whenever you have questions or need support. Our Member Success Team is highly trained and will work with you one-on-one to ensure you’re maximizing your results from your CRM!

Results-Driven Lead Generation

The best quality mortgage leads at the highest possible volume. With done-for you campaigns backed by over $2 Million in annual advertising data, and Billions of Dollars in loans funded directly from our marketing. We take all the lead gen off your plate and deliver warm mortgage leads directly to your pipeline.

Speed-To-Lead + Long-Term Nurture Campaigns

Never let another borrower slip away. From speed-to-lead automations that work for you even when you’re away from your desk, to long-term nurture campaigns that preserve your relationships with borrowers, Loan More CRM’s all-inclusive automations have you covered. It all comes together to help you fund more loans faster than ever, while freeing up more time for your business (and your personal life).

Full Service Onboarding, Coaching & Support

No other company comes close to the level of training, coaching, support, and service we provide. From our Member Success Team, Onboarding Specialists, Fulfillment, On-Demand Marketing, and our Mastermind Community of amazing, driven people who are there to support you. We could go on and on about how much we truly care about helping you succeed, but that’s just something you have to experience for yourself.

Your 5 Daily Habits For Growth

What should I do on a daily basis to maximize results from my mortgage CRM?

In addition to our done-for-you marketing and Loan More CRM, we give you all the coaching, training, and support you need to see massive results from our service. Our Onboarding Specialists are there to help you hit the ground running. Plus we have a full Member Success Team of real-life people who will be constantly supporting you every step of the way.

As part of our service and support, we provide extensive training, weekly coaching calls, and a full Mastermind Community of like-minded mortgage professionals. Taking advantage of Good Vibe Squad’s support, training, and coaching is extremely valuable, because it helps you understand exactly what to do on a daily basis to get results and profits for years to come.

Earlier on this page, we explained that Hybrid Automation is the perfect blend of automations + manual actions. Loan More CRM’s automations take massive amounts of the workload off your plate. When it comes to capturing and retaining your leads’ attention, Loan More CRM has you covered.

However, even the best automated system in the world cannot just step in, build relationships with borrowers, and close the loans for you. That’s why we encourage our clients to do some manual actions on their end when they have the time, so they can easily build relationships with leads and move them along toward pre-approval and closing.

We also want you to think about the mindset of leads who are in the earlier stages of your pipeline. These people are pre-qualified, they want your help getting into a home, but they’ve yet to have a heart-to-heart conversation with you. That means that the follow-ups need to be more persistent to keep these leads’ attention. Once you hop on a call and build a connection with them, then they’re less likely to get distracted.

But as far as strategy goes, the earlier a lead is in your pipeline, the more persistent the follow-ups should be on the front end to really keep that lead on track. That’s why we encourage you to do some manual follow-ups in addition to the automations we already have in place to really “double down” on keeping in contact with your leads.

We want you to be 100% certain on what you should do on a daily basis to maximize your results from your automated CRM. To help you, we’ve broken down our proven framework with these 5 Daily Habits For Success below:

- #1 Show Up On Booked Appointments

Showing up on your booked appointments should be your #1 priority. During each appointment, follow Good Vibe Squad’s proven phone framework and scripts to help you take applications over the phone and gain your leads’ trust.

- #2 Follow Up On Docs Requested

Loan More CRM will automatically remind leads to send in documents. However, we have found that it’s useful to manually follow up with these leads as well. The reason being, you’ve already taken the application, built some rapport with them, so it is indeed worth your time to step in and preserve that connection with them, reminding these leads how much you genuinely care about helping them get a great deal on their purchase or refinance.

- #3 Follow Up On No-Shows

From time to time, you may get some leads who book an appointment with you then for whatever reason forget to show up. This is just part of the mortgage sales process (It’s easier than ever for people to get distracted nowadays, so we’ve found that you sometimes have to be extra persistent when following up with leads on the front end).

Loan More CRM will automatically follow up with no shows on your behalf. However, we also encourage you to follow up with these leads manually as well. This increases your chances of getting that lead on the phone, so you can build rapport, take the application, and move them along toward pre-approval.

- #4 Follow Up On In-Contact

In-Contact Leads are people who have started a conversation with you, maybe you’ve taken the application from them, but life got in the way and these leads have stopped responding. Loan More CRM has In-Contact campaigns to automatically follow up with these leads on your behalf (to make sure they don’t ghost you altogether). However, we encourage you to take a minute or two to manually follow up with these leads as well. Again, timing is everything. If you have some free time in your day to hop on a phone call, go ahead and manually reach out to these leads. That additional manual outreach increases your chances of connecting with them over the phone.

- #5 Powerdial New Leads

The first stage of your pipeline is “New Leads.” These people are pre-qualified and want YOUR help buying or refinancing a home, but they haven’t yet scheduled an appointment with you. We recommend that you manually follow up with New Leads once a day, because you want to keep them moving along toward the later stages of your pipeline (The longer a lead sits in the “New Lead” stage of your pipeline, the harder it can be to convert them to a funded loan).

To help you follow up with New Leads in a fraction of the time, use our power dialer feature to quickly call your list of leads one after the other. We’ve seen this firsthand with 1000+ of loan officers: Just 10 minutes of power dialing each day will massively pay off in growing your loan volume.

Award-winning mortgage marketing agency

Inc. Magazine’s Power Partner Awards, Two Comma Club Awards, Featured In The Vision Magazine and Yahoo! Finance.