Marketing Services for Loan Officers

Solutions For Exponential Growth Backed By Billions Of Dollars In Funded Loans

With marketing trends and technology changing at breakneck speeds, it’s almost impossible to keep up. As a mortgage professional, trying out different marketing tactics can feel like throwing a bunch of darts at a board and hoping something with stick. It’s like running a marathon on a treadmill. You’re pushing yourself to the brink of collapse but not really getting anywhere in terms of growth.

So how do you know which marketing solutions will actually work? As in actually yield a solid ROI and help you build wealth over the long term? How do you know what marketing solutions will pay off, versus the ones that are just another “shiny object” distraction from your business?

Here at Good Vibe Squad, we don’t want you to waste any more time going through all that marketing trial-and-error. Over the years, we’ve pinpointed the mortgage marketing solutions that actually work, regardless of changing tech or ups-and-downs in the housing market. Unlike all the “shiny objects” out there, these marketing solutions are backed by actual results, with BILLIONS of dollars in funded loans! We’ve literally seen 1000+ of loan officers use these same solutions to scale their businesses and grow exponentially.

Since you’re reading this, we want to give you a ton of valuable insights that you can implement in your business. To simplify things, we’ve distilled these proven marketing solutions into 5 main categories. Each category solves a major problem that loan officers deal with on a daily basis.

- Unique Value Proposition / The Problem: Being Rate-Shopped Or Commoditized

- Leverage Your Niche / The Problem: Getting Stuck In The Mortgage Rat Race

- Pre-Framing Marketing / The Problem: Leads Not Showing Up To Appointments

- Homebuying & Refinance Education / The Problem: Borrowers Feeling Anxious Or Hopeless Throughout The Homebuying Process

- Trust-Based Marketing / The Problem: Struggling To Gain Your Leads’ Trust & Build Rapport

Throughout this page, we’ll break down each marketing solution, what it is, and why it solves these major problems. Next, we’ll show you the proven tactics that our clients use to overcome these problems and scale their businesses.

Awesome! Let’s dive in.

Unique Value Proposition

How Top Producers Overcome Rate-Shoppers & Outclass The Competition

Nowadays, loan officers are commoditized, rate-shopped, and taken for granted. Because people are (falsely) led to believe that interest rates are the end-all be-all of lending, they’re drawn toward big banks and predatory lenders who advertise low, low rates. As a result, borrowers are often being duped into paying for hidden fees.

Most borrowers are not aware of the level of expertise and customer care that goes into putting together a loan package that’s best suited to THEIR specific home buying needs.

This false belief system leaves both lenders and borrowers at a massive disadvantage. For local lenders who genuinely care about their clients, they have to compete with big banks to get ahead. For borrowers who just want the best value on their home purchase or refinance, they’re misled into opting for the lowest rate without taking the overall big picture into account.

So how do you bypass rate shoppers? How do you prevent borrowers from comparing you to big banks and low-rate lenders? How do you communicate the value you provide as a mortgage advisor, making it impossible for prospects to compare you to your competition? The answer is something we call a “Unique Value Proposition”

A Unique Value Proposition is a type of offer that is:

Unique – You can’t be compared to competitors

Irresistible – People feel stupid saying no to it

Zero Risk – There is no downside for your customer

So HOW do you create a Unique Value Proposition for your business? Seems like a lot of work… but the great news is that we’ve already created this Unique Value Proposition FOR you as part of our done-for-you marketing campaigns!

This Unique Value Proposition allows loan officers to set themselves apart from the competition, bypass rate-shopping, and show their borrowers the massive amounts of VALUE they have to offer! (To learn more and see how this Unique Value Proposition plays out in action, click here to book a free demo.)

Think about whatever incentives you have to offer as a lender. Maybe you have access to closing cost assistance, a faster turnaround time, 10+ years of mortgage experience, maybe you’re extremely skilled at helping clients with credit or getting them a larger maximum loan amount. These incentives do NOT have to be rate or price based. Whatever incentives you have, our Unique Value Proposition puts a name and a story to that. It’s like a flashing neon sign that highlights all the VALUE you have to offer as a local mortgage advisor.

When prospects see your Unique Value Proposition, it helps them realize “Hey, this lender is different. They have special incentives to offer me, and I can probably get a great deal if I work with them.” That’s exactly the type of response loan officers get when they use this Unique Value Proposition in their business!

Leverage Your Niche

Break Free From The Mortgage Rat Race And Grow Your Referrals

When you’re struggling to grow your mortgage business, it can seem like an endless cycle of ups and downs (imagine a series of waves rather than a sustained, exponential growth curve). The problem is that so much work goes into funding a single deal, but once that loan goes through, then it’s back to Square One chasing after your next lead. It’s a vicious cycle that drains you of your time, energy, and resources.

But what if there was a way to really multiply your deals, so for every client you help, they refer you to 1-3 friends or family members in return? We’ve actually seen this happen with our clients by helping them to leverage their niche. As part of our done-for-you marketing campaigns, we have several different niches that you can target, depending on your own specialties as a mortgage professional.

For instance, let’s say you specialize in VA loans. That means you already have a ton of momentum and know-how when serving your veteran clients, so we want to leverage that in your favor!

In this case, we set up ad campaigns that specifically target veterans or military personnel. So when you get these leads on the phone, you already have something in common with them and it’s much easier to build that connection.

In addition to veterans and military families, we have other niches to target your ideal prospects based on their occupation. These niches include: teachers and educators, healthcare professionals, first responders, government employees, union members, and more.

These types of campaigns work REALLY well at targeting your ideal clients. Because these groups are professionals, they’re more likely to have the income, credit, savings, and W2 required to qualify to buy a home!

But here’s the BEST part about this: These groups are incredibly tight-knit (meaning talk travels fast within these communities). So once you break into a niche and help out one person from each group, that client will start referring you to their friends and family members. Pretty soon, you become the “go-to lender” within that community!

We have literally seen this firsthand. Our clients will use this strategy of leveraging their niche, then for every deal they close, they get 1-3 client referrals back in return!

Want to learn how you can leverage your niche to grow your referrals and break free from the mortgage rat race? Click here to book a call with us!

Pre-Framing Marketing

Get Leads To Know, Like, And Trust You – Before They Even Speak With You!

Before we dive into pre-framing marketing, let’s take a second to touch on lead generation.

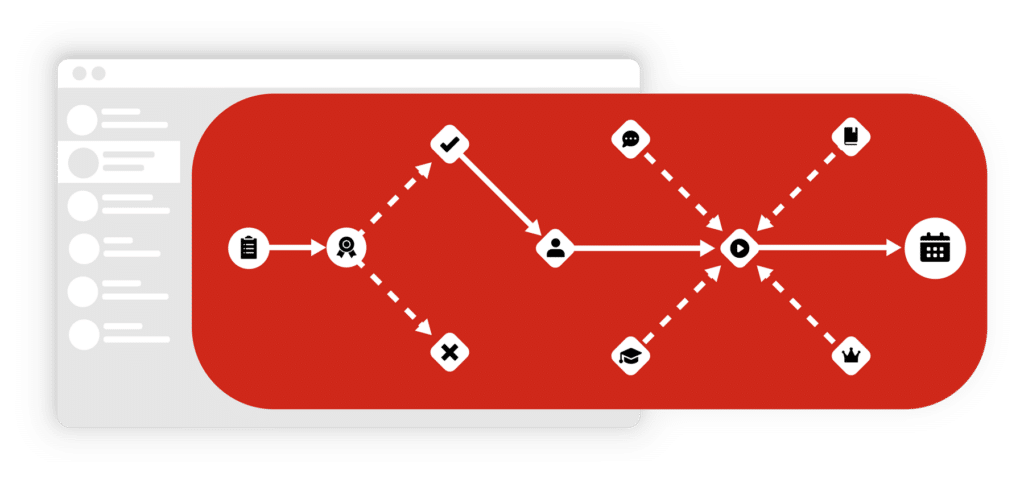

Generating the best quality leads isn’t as easy as just attracting the leads, pre-qualifying them, getting their info, and booking them to your calendar.

Here’s what a lot of lead generators get wrong: they treat leads like numbers. And sure, it is a numbers game, but on the other end of that computer or phone screen is a real human being who NEEDS your help.

This is the big challenge with internet leads: making everything feel real and human. Until the lead has a real person-to-person conversation with you, the reality hasn’t sunk in yet. They don’t see you as a human being, so they don’t know, like, or trust you… YET.

This challenge is why, compared to referral leads that you get from a realtor, internet leads are more likely to ghost you or forget to show up to the booked appointment.

Now obviously, we want your leads to show up to their booked appointments, but we also want them to show up with the right expectations in mind.

We want the reality to truly sink in, so they’re thinking about all the positive emotions that go into buying their home, or getting a great deal on their refinance. We want them to get excited about talking to a mortgage advisor who’s there to HELP them, as opposed to feeling like they’re walking into some transaction-based sales call.

As part of our done-for-you marketing, we walk your leads through a customized Thank You Page after they book an appointment with you. This Thank You Page features your headshot and links to your reviews, which helps to gain your leads’ trust and get them excited about speaking with you. But that’s not all…

We also send out pre-framing videos AND guides on your behalf. These pre-framing assets tell your leads what to expect before the booked appointment, so they go in with the right expectations in mind. These assets also help to bolster your personal brand and establish your authority as a mortgage advisor.

Another great thing about these pre-framing assets is that they get the lead picturing what their life will be like once they buy or refinance their home! This is the emotional benefit that brings up the lead’s level of trust and excitement before the appointment.

Pre-framing marketing solutions have paid off exponentially for our clients! It vastly reduces no-show rates and helps our clients have more positive and productive interactions with their leads.

Want to start using pre-framing marketing in YOUR business? Click here to see our pre-framing marketing process in action!

Homebuying & Refinance Education

Provide Hope And Empower Your Borrowers Throughout The Financing Process

When you put yourself in your prospect’s shoes, navigating all the ins and outs of the loan application, submitting documents, types of mortgage programs, plus all the complicated home buying terms like escrow accounts, conditional approval, PITI payments, and more… pile that ON TOP OF the depressing headlines they’re constantly hearing in the news…all this info can quickly overwhelm your prospects and leave them discouraged.

But by taking all the complicated information and breaking it down into bite-sized educational nuggets, this can come as a serious relief. Educating your prospects provides reassurance that buying or refinancing a home isn’t so daunting after all. This gives them hope and makes your leads more willing to open up.

As part of this educational piece, our marketing team has done extensive research and created several done-for-you educational resources such as a Step-By-Step Roadmap To Homeownership For First-Time Home Buyers, a Home Moving Guide, a Guide To Homeownership, Credit Repair & Maintenance Guides, Refinance Guides, and more!

These resources have resulted from our in-house copywriters, video editors, graphic designers, web designers, and even our automation specialists working together to create high-quality educational content that we build into our done-for-you marketing campaigns!

Not only do these resources provide loads of educational value to your prospects, they also help to bolster your personal brand and establish your authority as a mortgage advisor. It shows how much you truly care about educating your clients and guiding them along their journey.

Best of all, these done-for-you educational resources are already built into our automated follow-up campaigns! So you don’t even have to think about sending them over. Depending on the type of lead, they’ll automatically receive the appropriate educational resource to get them interested in speaking with you. (For example, if they’re a refinance lead, they will receive educational resources to help them prepare for refinancing their home.)

Complete Homebuying & Refinance Book Guides

It all comes down to taking all the complicated homebuying and mortgage lingo, simplifying it so the average consumer can easily understand, as well as branding these guides in a positive light, so your prospects are hopeful and excited to move forward with you.

Educational Videos

We write, shoot, edit, and send out educational videos to your leads on your behalf, so they can easily watch a quick video to help them along their journey. We’ve found that in addition to the education piece, these videos are also extremely powerful from a branding perspective, as they help you to stand out amongst the competition.

Credit Maintenance & Repair Resources

Many borrowers are unaware of the common credit missteps that hurt their chances of getting approved. Our done-for-you credit resources help them avoid those common mistakes. Furthermore, if a prospect needs a little more time to repair their credit, we send them credit repair-specific guides to encourage them along the way.

Long-Term Nurture Educational Campaigns

For leads who need to wait 3-12 months before buying, we automatically follow up with them on your behalf to keep your name fresh on their mind. These long-term follow-ups include educational resources about the homebuying journey, giving your leads hope and helping them picture what their life will be like once they reach homeownership.

Refinance Specific Educational Campaigns

These follow-ups are similar to the long-term nurture campaigns, except they’re built out specifically for refinance leads.

For prospects who need to wait 3-12 months before refinancing, we automatically follow up with them on your behalf to keep your name fresh on their mind. These long-term follow-ups include educational resources about the ins-and-outs of refinancing, along with all the incentives they can get when they refinance through you.

Credit Building Educational Campaigns

The average consumer doesn’t know all the steps that go into buying a home. That’s why we break down this step-by-step process for them, so they know what to expect at every turn. This breakdown also includes several essential tips that they need to know (such as the importance of getting pre-approved BEFORE shopping for homes).

Trust-Based Marketing

Build Fruitful Relationships With Clients That Last A Lifetime

In order for you to catapult yourself above the competition, stand up to big banks and become THE go-to lender in your region, you absolutely must gain your prospects’ trust. But building trust is a two-fold requirement:

Prospects need to trust (and believe without a doubt) that you are a mortgage, homebuying, and refinance EXPERT. Meaning they have full confidence in your skillset and experience as a mortgage advisor. But that’s not all…

Prospects ALSO need to trust that you genuinely care about helping them. Meaning you have strong moral values, you put people first before commissions, and you have an upstanding level of integrity and customer care when it comes to getting your clients the very best deal possible on their home purchase or refinance.

We use this trust-based marketing strategy as part of our Unique Value Proposition, done-for-you branding, educational resources and pre-framing marketing assets. But a huge component of this trust-based marketing boils down to YOUR interactions with leads. While all your competitors are saying one thing, you need to know how to take a sharp left turn with your messaging AND your delivery.

The messaging you use needs to act as a disruptor to immediately gain your leads’ trust, establish your expertise as a mortgage professional, and prove that you have upstanding values and are genuinely there to help them – regardless of commissions. But there is an art and a science to this…

After working with over 500+ mortgage professionals over the years, studying the top producers and listening to thousands of hours of sales calls, we’ve created an extensive training & coaching program to help you fine-tune your messaging and master your sales conversations.

In addition to all the trust-building assets we provide as part of our done-for-you marketing, here’s how we help loan officers master their messaging and gain their leads’ trust:

SALES & NURTURE TRAINING

When our clients first onboard with us, we train them on how to best leverage our done-for-you marketing assets. This training is incredibly valuable because it really drives home the messaging you want to use when interacting with leads.

PROVEN SCRIPTS & PHONE FRAMEWORKS

We also provide word-for-word scripts, phone frameworks, and templates that take the guesswork out of your sales conversations. These scripts tell you exactly WHAT to say to gain your leads’ trust, along with the WHY behind these trust-building strategies.

WEEKLY LIVE COACHING CALLS

We seriously cannot stress enough how valuable these weekly coaching calls are. On these coaching calls, you’ll connect with high performance mentors and top producing loan officers, learning all the tips and tricks for overcoming objections, and getting leads to immediately see the massive amounts of VALUE that you provide as a trusted mortgage advisor.