There are a lot of moving parts to a real estate transaction and several key players collaborating to close the deal. If you’re new to real estate lingo, you may have a lot of questions. One of the most common questions we get is, “is there a difference between a mortgage broker and a real estate agent?”

Keep reading to learn what real estate roles have in common and what makes them different so that you can choose the right partnership to invest in.

Key Takeaways

- Real estate agents and mortgage brokers are both licensed professionals who work with clients interested in acquiring real estate properties.

- The terms “mortgage broker,” “real estate broker,” “realtor,” “real estate agent,” and “realty broker” are often used interchangeably, but a broker negotiates on a buyer’s behalf while an agent represents the buyer or seller at all times.

- Real estate agents may be classified as realtors, seller’s agents, buyer’s agents, or dual agents, each with different roles and responsibilities.

- Mortgage brokers act as liaisons between the lender and the borrower to find the best loan to meet the borrower’s needs, while loan officers represent the lending institution.

- Both roles offer great business opportunities with flexible income potential, but the best way to decide which role to pursue is to consider whether you want to interact more actively with clients as an agent or prefer the task-oriented duties of a broker.

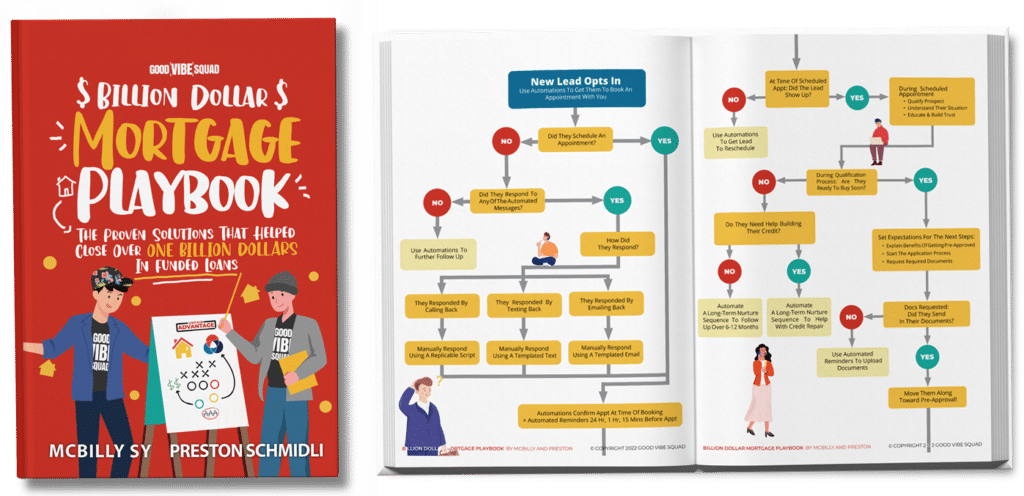

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Real estate agent vs. mortgage broker

Real estate agents and mortgage brokers share similar requirements. Both are licensed real estate professionals within the industry. Each role works directly with clients interested in acquiring real estate properties — both commercial and residential.

When you start digging into the real estate market, you hear a lot of interchangeable terms like:

- Mortgage broker

- Real estate broker

- Realtor

- Real estate agent

- Realty broker

All these similar terms get used interchangeably and confuse consumers. Real estate brokers have additional training and certifications that allow them to originate mortgage loans.

To simplify it for you, we’re going to divide all these titles into two key phrases:

- Broker

- Agent

A broker is a person who negotiates on a buyer’s behalf in tandem with the lender. An agent represents the buyer or seller at all times and does not negotiate any loan terms. However, the agent may negotiate the cost of a property purchase for a buyer or a seller.

Breakdown of a real estate agent’s role

Real estate agents are sales professionals licensed to conduct real estate transactions. They generally work under a real estate broker. Their main focus is to represent the buyer or seller transaction.

Different types of real estate agents

As mentioned previously, we can assume that the term “agent” is a person who represents a buyer or seller. Since real estate agents take on different roles, they are labeled differently. The real estate hierarchy can seem complicated when you realize there are a lot of terms used in the industry. It’s easier to get comfortable with the lingo once you understand the basic terms.

- Realtor. A realtor carries a membership to the National Association of REALTORS®. While a realtor still performs the usual responsibilities as a regular real estate agent, they may take on other duties and perform as an associate broker. Realtors may charge more than other types of real estate agents.

- Seller’s agent. A seller’s agent is also referred to as the listing agent since they represent the seller. The seller’s agent is a marketing professional whose intention is to position the property in the most positive light to close a sale. They assist the seller by listing the property on a Multiple Listing Service (MLS) database.

- Buyer’s agent. The buyer’s agent solely represents the buyer. They are sales professionals with diverse market knowledge. They are the agents that will most likely specialize in specific neighborhoods and know all about the demographic areas to promote a property to the buyer. They are also responsible for showing the properties to prospects.

- Dual agent. A dual agent represents both the seller and the buyer. Representing the buyer and the seller may not be in anyone’s best interest but the agents. Some people choose to be a dual agent so that they don’t have to split the commission between the buyer’s or seller’s agent.

Dual agency can spark caution for potential clients since a buyer’s interest is in conflict with a seller’s interest. Both want the best deal. A buyer may attempt to negotiate down while a seller may want to negotiate at cost or higher if there is competition.

Breakdown of a mortgage broker’s role

Unlike a real estate agent, the broker acts as a liaison by working with both the lender and the borrower. They must have additional licensing that enables them to perform duties within the lending sector. The broker works in the interest of the buyer or borrower to find the best loan to meet the borrower’s needs based on qualifications. The broker’s goal is to find the borrower the best:

- Loan type

- Interest rate

- Loan terms

- Lowest closing costs

Because mortgage brokers’ responsibilities cross over into the lending field, they are often confused with loan officers.

Difference between mortgage brokers and loan officers

Both mortgage brokers and loan officers share similar knowledge and responsibilities. They are often confused since a mortgage broker may originate mortgage loans. The difference between the two roles is that the broker acts in the borrower’s interest, while the loan officer represents the lending institution.

The loan officer is licensed as a mortgage loan originator (MLO). There are licensed professional loan officers and registered loan officers. Registered loan officers typically work directly for a lending institution, while licensed loan officers have more stringent educational requirements.

As stated earlier, a broker negotiates on behalf of the buyer/borrower. On the other hand, the loan officer becomes the sales representative representing the lending institution. Their goal is to provide you with the information you need to choose the best mortgage that fits your needs.

Is it best to be a real estate agent or a broker?

Being a real estate agent or a broker has advantages. Many professionals choose to start off as agents before transitioning into more complex roles like a broker or a loan officer. Both roles offer great business opportunities with flexible income potential. The best way to decide is to ask yourself. Do you want to interact with the clients more actively as an agent, or are you more task or process-oriented and prefer the duties performed by the broker?

The differences are in the outcome in real estate

While there are crossover functions between real estate roles, there are key differences between a mortgage broker and a real estate agent. The real estate business is a complex system for someone getting started. However, you can contact us if you have any questions.