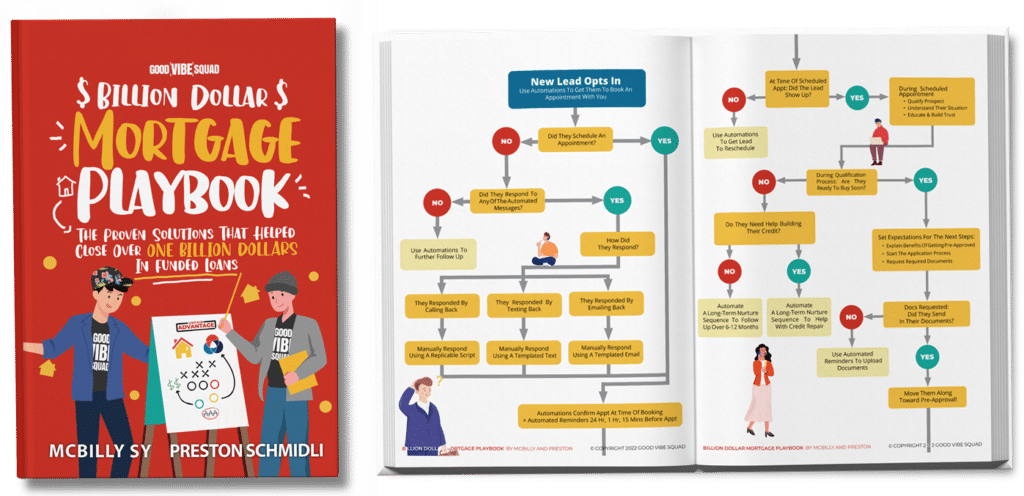

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

So your client isn’t quite ready to pull the trigger. Here’s your next move.

An Interested Borrower Says, “I’m 6 to 12 months out from buying a home.”

As a loan officer, you’ve probably gotten that objection before. But more often than not, when a prospect says they’re a year away from buying a home, that’s not necessarily the case! They could have excellent credit AND plenty of savings but still think they’re not ready.

The fact is, a lot of your clients may be working with bad intel from a friend or family member. Their loved ones could have ranted and raved about how “impossible” it is to qualify, giving your client the wrong idea about what it really takes to get approved. So when a lead tells you they’re a year away from buying their dream home, this can be less of a fact and more of a cry for help.

There’s a big difference between thinking you have to wait 6 to 12 months and actually wanting to wait before buying a home.

For these prospects, it’s important to ask deeper questions WITHOUT being confrontational. When a client gives you this objection, make sure to honor that statement while also digging a little deeper.

Simply saying, “Ok, so it definitely makes sense you say you’re 12 months out, but if you don’t mind my asking, why do you think you’re that far out from buying a home?”

Generally, your prospect will tell you why. “I don’t have the credit or the savings ready to qualify.”

In that case, you should respond with something like, “Ok, so I definitely understand where you’re coming from. But just to clarify, if those weren’t issues for you, would you still have the desire to buy a home a bit sooner?”

They might say, “Yes, I definitely want to get into a home sooner than that.”

Or, “No, I want to wait 6 to 12 months before making that move.”

If they still want to wait, that’s totally fine! You can follow up with them later on when they’re ready.

But if your client has the desire to move faster than that 6-12 month timeline, then you can educate them about the realities of getting approved. “Ok, I see you feel like you’re not ready because of (reason A, B, or C), but that’s not necessarily the case. Let me put together a plan of action so we can get you there sooner.”

Make sure to validate their concern and honor what they say. But by asking deeper questions, you can better understand your client’s beliefs about what’s holding them back from their dream.

By taking the time to understand and educate them on the realities of buying a home, you’re building trust with your prospects. These people will want to work with you because you took the time to address their insecurities and offer them hope that their dream home isn’t as far away as they originally thought.

The takeaway? When a prospective borrower tells you they’re 6-12 months out, you should stop looking at this as an objection and start seeing this as a cry for help. Your job is to give them hope by educating them. They need someone like you who is qualified to show them what it really takes to get approved. With your help, your clients will overcome the misinformation they’ve heard from before.

I hope this article gave you some insight on how to close more funded deals! For more resources on funding more loans and growing your mortgage business, learn more about our mortgage lead generation program.