Real estate professionals tend to take on many roles to remain competitive in the industry and maximize profitability. Some professionals may even wonder, “can a real estate agent be a loan officer?”

The short answer is yes. A real estate agent can be a loan officer and visa versa. It may seem like a no-brainer to take on both responsibilities when trying to streamline your business. However, becoming a loan officer and a real estate agent at the same time can pose ethical challenges with limitations.

Key Takeaways

- Yes, a real estate agent can be a loan officer, but there are ethical challenges that come with taking on both roles.

- Loan officers focus on loan qualification, while real estate agents focus on sales and have knowledge about the market, industry trends, and demographic data.

- Realtors can become loan officers, but regulations were put in place to avoid conflicts of interest and protect the lender and borrower.

- While being licensed as both a loan officer and a real estate agent can be advantageous, there are restrictions, such as not being able to offer FHA loans.

- Instead of taking on both roles, it may be easier to choose one path and focus on finding the right real estate referral partners to manage business growth.

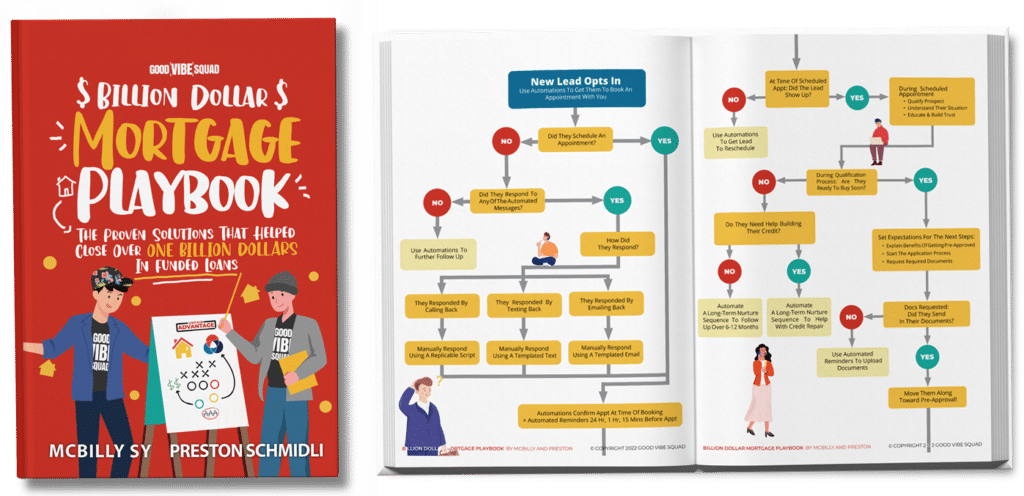

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Loan officers vs. real estate agents

Loan officers and real estate agents have different license requirements. A real estate agent’s focus is sales. The entire process is sales-oriented — from finding leads to finding the right home or commercial property for a buyer.

A real estate agent is acting in the interest of the buyer or seller. The agent is required to have knowledge about the market, industry trends, and demographic data.

A loan officer’s process is less sales-oriented, although sales are always a requirement for lead acquisition. Unlike a real estate agent, a loan officer’s sales process can be less hands-on and more automated with systems like the Unfair Advantage™. The loan officer represents the buyer and acts as the liaison between the borrower and the lender.

Responsibilities of loan officers

A loan officer’s role is more data-driven and focused on loan qualification. They don’t need to know about area demographics. All focus is if the borrower can qualify for a loan. A loan officer would only need to remain knowledgeable about any industry impact changes that could affect the bottom line of approval odds for future clients.

Responsibilities of real estate agents

The best real estate professionals have a wide range of industry knowledge and training to remain in demand in a highly competitive market. They are not only knowledgeable of housing trends and current market value rates but also specialize in knowing details about area demographics like

- Local schools

- Neighborhood

- Salary mediums

- Local businesses

A real estate agent is also responsible for knowing basic loan requirements and any industry-impacting changes for the different mortgage loan types.

Can realtors be loan agents at the same time?

It is legal for realtors to become loan officers at the same time. However, regulations were created to avoid conflicts of interest that can lead to poor business ethics.

The Real Estate Settlement Act (RESPA) ensures that there cannot be any transactional benefits between a loan officer and a real estate agent (adwerx.com). This restriction protects both the lender and the borrower from unethical behaviors that are motivated by financial gain.

- A real estate agent may not represent the same client in the role of both the agent and the loan officer at the same time.

- Licensed loan officers may not offer FHA Loans for a client while acting as the agent.

While a loan officer may represent conventional mortgage loans while acting as the agent, most real estate agencies prefer not to work with individuals with both licenses. This prejudice is a strict act of liability control.

Many real estate professionals choose to become licensed as both the agent and the officer because it allows them the flexibility to earn an additional independent income. Unfortunately, they cannot be employed by an FHA-approved lender or by an agency that originates FHA loans since the agency does not want the liability of ensuring that the agent/officer remains compliant with the regulations. The FHA will cite lenders for having employees with outside employment that violates any regulations.

Pros and Cons of Dual Roles

Pros

1. Increased Income Potential: By holding both professional titles, you can increase your income potential as you juggle multiple sources of income.

2. Streamlined Process: As a dual role holder, you can streamline the home buying process by spotting common pitfalls ahead of time and preventing them.

3. Better Understanding of the Process: Performing both roles gives you more specialized knowledge and a deeper understanding of both the homebuying and financial side of the mortgage process.

Cons

1. Ethical Issues: Holding dual roles can pose several ethical (and even legal) issues when it comes to remaining impartial.

2. Time Management: Holding dual roles can be time-consuming. You will need to balance your time between finding properties for your clients, securing financing for them, and staying on top of follow-ups.

3. Additional Training and Licensing: Separate licensure processes can be time-consuming and costly, especially if you’re looking to practice in multiple states.

Should you pick one or choose both?

It can be advantageous for a loan officer to become a licensed real estate agent. This allows one to promote themselves as a one-stop shop. Some restrictions can still impact your bottom line, like not being able to offer an FHA loan.

This limitation affects your qualification pipeline since these government-backed loans are the most popular loans for first-time buyers. The FHA loan is the most flexible loan for a wider range of buyers.

A real estate agent can be a loan officer

A real estate agent can be a loan officer at the same time, but the restrictions put into place by industry regulation do pose a challenge. Each role performs dynamic responsibilities that take focus and time.

The truth is- you really don’t need to be both. It’s actually easier to choose one path when you have a marketing growth strategy in place keeping your pipeline so full you won’t have time to take on both responsibilities (and won’t need to). Instead of trying to do both, you can schedule a strategy call with us to learn how to find the right real estate referral partners to manage your business growth.