Like many things, marketing has drastically changed over the past several years. One of the most significant recent changes has been how popular social media has become and how strong a platform is for hosting ads.

As of May 2021, Facebook reported that they have more than 2.85 billion active monthly users. This number is expected to grow in the coming years, so investing in ads on sites like this is becoming crucial to a business’s success.

Let’s look at how mortgage lenders can use Facebook’s ad services to generate leads and grow their businesses.

Key Takeaways

- Facebook ads use specific targeting to reach the right people who are more likely to be interested in the advertised product or service.

- Facebook ads have different bid types, including CPC and CPM bidding, which charge differently based on clicks or views.

- Facebook ads have various types, such as photo, video, and text ads, which can reach a wider audience and blend seamlessly with regular Facebook posts.

- Facebook ads are useful for generating mortgage leads because they provide better leads, are less likely to be abandoned, and allow for multiple marketing efforts.

- Successful Facebook mortgage ads target customers using location and psychographic targeting, use retargeting to remind users who clicked on the ad but did not submit information, set the right budget based on the cost per lead and desired leads per month, and create landing pages that speak directly to the target audience.

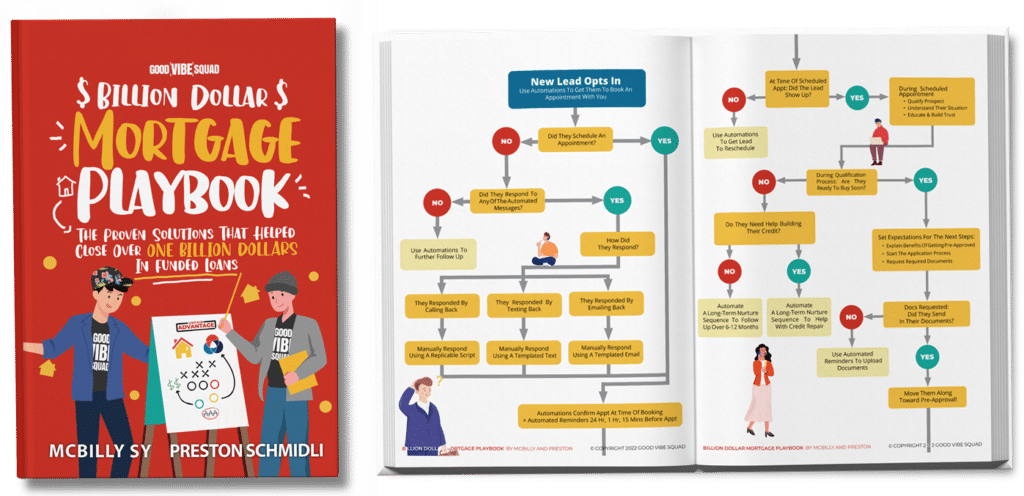

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

How do Facebook ads work?

Like many other kinds of advertising, Facebook ads work by targeting people who are statistically likely to appreciate the product or service being advertised. Facebook will consider a person’s location, age, profile data, and other demographic information to determine the best possible audience for the ad.

Facebook ads are composed of a few different components, including the ad type, targeting, placement options–like newsfeeds or Messenger, the bid and budget, and the schedule for when and how long your ad will run. Ad types will be further explained in the next section, but let’s first explore more about Facebook’s targeting process and why it’s so invaluable.

Targeting

The biggest reason why Facebook ads are so effective is that they use specific targeting to ensure that the right people–those who would actually be interested in the product or service offered–are the ones seeing the ad. Facebook ensures this by filtering its users by location, age, relationship status, income status where available, interests, and many more factors.

Bid types

On Facebook, a bid represents the amount of money that a company or business is willing to pay to have customers both see your ad and do whatever action the ad prompts them to. There are a few different ways you can bid on Facebook ads, including CPC and CPM bidding.

CPC bidding, or Cost Per Click bidding, only charges the company when individuals click on the advertisement listed. It is a bidding strategy that is usually highly recommended when advertising through social networking sites. It drives traffic to your business without charging you for ads seen but never explored by others.

CPM bidding, or Cost Per Impressions bidding, charges companies per every one thousand views their ad gets, no matter whether the ad is clicked on or not. This bid type is less popular because it can be harder to see lead generation.

Types of ads

There are many different ad types that Facebook uses to ensure a wide viewership is reached. Among these types are photo ads, video ads, and traditional text ads.

- Photo ads usually blend right in with normal Facebook posts, as they follow the same format. People may be more likely to read through them in this format because their eyes will naturally flow from one post to the ad, not noticing any change until they are already invested in the material.

- Video ads can come in many different places. They, like photo ads, can be found in someone’s regular feed, but they can also be seen as a break in the middle of another video a viewer is watching or even listed as a Facebook Story.

- Text ads are basically regular posts without a photo or video with them. Typically, these can receive less attention, as they usually don’t have much that grabs the casual scroller’s attention.

Facebook ads vs Google ads

What is the difference between Google ads and Facebook ads? Google ads are considered paid search advertising, meaning that you bid for specific keywords and your ad appears when a consumer searches for those keywords. Facebook ads, in contrast, display ads to consumers that they think will be interested in the services advertised. For example, Facebook users talking about looking for a new home or moving may receive a mortgage ad. In general, Facebook ads have a lower CPC than Google ads because they are not directly targeting users searching for mortgage information.

Mortgage ads on Facebook

Mortgage ads are like any other ad listed on Facebook. They generate leads and encourage customer interaction, but there are still a few key differences to note when creating one such ad.

Advertising strategy

Unlike other customers online, those who are going to be interested in mortgage loans are going to have a much higher emotional investment in the process. This is because they’re not just looking to buy a new pair of shoes or tickets to a concert. Instead, they’re purchasing their first home, their family’s dream home, the place where they’ll spend most of their time and holidays. Therefore, mortgage industry advertisements need to have a big impact on customers.

Moreover, mortgage ads fall under the Special Ads category of Facebook. Unfortunately, creating ads is more challenging because you are given limited options, including age, gender, location, and certain demographics.

Use retargeting

Retargeting is a strategy that considers a customer’s browsing history on the company website to determine which future ads to send their way. For example, if John saw advertisements for a mortgage loan website and visited it to compare rates, the site may gather information on which loans he was interested in and send him ads about various interest rates or other features they offer.

Provide valuable content on the landing page

The landing page is the first page anyone will see when they visit your site, so you need to make it as helpful and informative as possible. To do this, try to focus attention on the most pertinent information people need when considering your mortgage loan company. It can include testimonials, rates, special services, and more.

3 reasons to use FB ads to generate mortgage leads

There are many reasons why generating mortgage leads through Facebook ads is useful. Facebook ads provide better leads than Google ads, leads are less likely to abandon queries, and you can use multiple marketing efforts to get more leads.

1. They have better leads than Google ads.

Facebook generates a better lead pool than Google does for its advertisements. This is because Facebook bases its target audience on audience interest, whereas Google uses keywords to target individuals looking for a product. This means that while Facebook ads can gain you a larger audience, Google ads will only reach those who are already confident about a product or service.

2. Leads are less likely to abandon queries.

With Facebook ads, leads are much less likely to abandon a query than those from other marketing strategies. This is because Facebook audiences are already interested in the product or service offered. They want to know more, so Facebook shows them your ad to encourage lead generation and development.

3. Multiple marketing efforts are encouraged.

Facebook doesn’t limit you to one type of advertising or marketing. Instead, it encourages growth through additional strategies like email marketing. This can double the amount of attention you get per advertisement.

Getting started with Facebook ads

Deciding to create an ad through your Facebook page is relatively easy and allows for a wide range of creativity and features when it comes to mortgage marketing.

Ad creatives

This refers to the imagery and visual information contained within your Facebook ad. This can include everything from photos or videos to ad copy and call-to-action buttons that link directly to your website.

Audience

Here is where Facebook allows you to build your target audience. In other words, who would benefit from seeing this ad? You want to create an audience based on features such as age, gender, geographical location, and interests. For example, if you focus on first-time homebuyers, you would want to choose a younger age demographic.

Budget

Here is where you determine your Facebook ads budget. While Facebook does not always require a minimum budget, some types will require this. Facebook also offers budget suggestions based on the type of ad and target audience.

Duration

How long do you want your ad to run? While you may choose to keep a particular ad with an unlimited duration, Facebook allows you to set a duration time if you like. This is especially beneficial when creating time-specific ads, such as limited-time specials or benefits.

Placement

Here is where you can decide where Facebook will place your ads. While it is recommended to choose all areas, you can unselect specific locations where you do not want your ad placed. For example, if your target audience does not include Instagram users, you may unselect this ad placement location.

Factors for successful Facebook mortgage ads

The following tips will help you achieve greater success when using Facebook ads in your marketing strategy.

Target customers

When creating your Facebook ads, it is important to take advantage of the ad targeting feature. This allows you to define your ideal audience, only showing your ad to your ideal clients. Here you can implement specific targeting filters based on location, age, and detailed targeting. For example, you can adjust your settings so that your ad only appears to users in your city that are within a specific age range and fall under specific categories, such as those looking to move.

Location

As a mortgage loan officer, you are likely looking for borrowers in your local area. When creating your Facebook ad, you want to highlight this local area and be sure to set your target location for the area you serve.

Psychographic targeting

Psychographic marketing expands on normal demographic data such as location, age, and gender and instead focuses on a borrower’s activities, interests, and opinions and how they drive consumer decisions. Taking these factors into account can help you better define your target audience.

Retargeting

Retargeting allows you to display Facebook ads again to those users that clicked on the ad but did not submit information. Borrowers can need up to nine touchpoints with a loan officer before they decide to apply for a loan or inquire about additional information.

Budget

Setting the right budget is essential to the success of your Facebook ad strategy. When using Facebook ads for lead generation, it is important to consider your average cost per lead and then multiply this by the number of leads you hope to generate. For example, if your average cost per lead is $15 and you are looking to generate at least 100 leads per month, then your monthly Facebook ad budget would be $1500 per month.

Landing pages

A landing page is a standalone web page that is created specifically for a marketing campaign. Creating specific landing pages for your Facebook ads allows you to further target a specific audience by offering information that directly speaks to them.

Leveraging ads to increase lead generation

Facebook advertising provides a powerful tool that can help boost your monthly lead generation and become a valuable part of your overall marketing strategy. By focusing on your specific target audience and your ideal clients, you are more likely to generate quality leads that are more likely to convert and boost your bottom line.

When you still need help with lead generation

If Facebook ads and your marketing strategy are still not generating the volume of leads you need each month to reach your goals, the team at Good Vibe Squad can help. Our powerful lead generation tools, including a mortgage-specific CRM that can help you automate many areas of your marketing strategy, can give you the boost you need to reach the level of success you are striving for.

To learn more about how we can help, book a strategy call today.