There are currently more than 2.85 billion active Facebook users around the world today, and that number is only expected to grow in the coming years. This makes Facebook an excellent place to advertise products and companies, as hundreds of millions of people may potentially be reached through a Facebook ad.

But if you don’t create the ads properly, they won’t work for your business at all. If you don’t pay attention to your searcher’s intent, Facebook’s ad policies, or your own landing page quality, then any Facebook advertisements you create are sure to fail.

For more detailed information on how Facebook ads work, check out our article: Facebook Mortgage Ads for Generating Leads.

Key Takeaways

- Understand the searcher’s intent when creating Facebook ads for your mortgage business to avoid wasting time and resources on ineffective ads.

- Stay up-to-date with Facebook’s ad policies and guidelines, especially with regard to the Special Ads category, to avoid facing consequences like ad removal, lowered page quality, or even a ban on Facebook activity in the future.

- Ensure that your Facebook page and landing page are of good quality to attract potential clients and avoid getting flagged for violating Facebook community guidelines or having a low-quality rating.

- Avoid wordy ads, broken URLs, and using Facebook or Instagram trademarks to prevent technical difficulties with your ads.

- Facebook ads can be an effective way to generate leads for your mortgage business, but it’s important to follow the rules and create ads that resonate with your target audience.

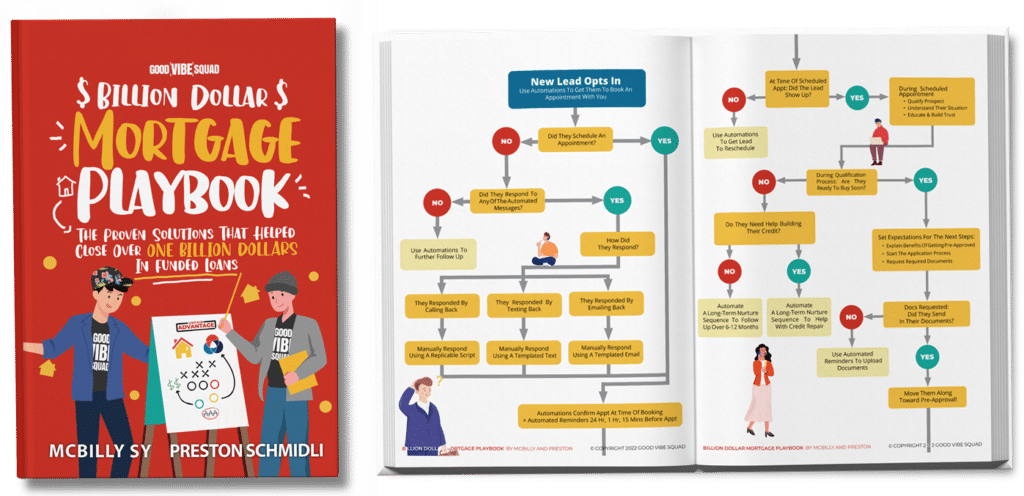

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

1. Searcher’s intent

Facebook advertisements have many things going for them, but they also have strong weaknesses–determining the searcher’s intent is one of them.

As a loan officer, there are several factors you need to take into consideration when you’re looking for qualifying leads, including age range, financial status, and other key demographic determiners. If you don’t know exactly which group you want to advertise to and don’t take the time to ensure they are the ones receiving your ad, then Facebook ads may prove useless to you. In that case, you will have wasted both time and resources on an ad that will not work for you.

2. Not complying with the Facebook ads policies

Facebook ad policies are in a constant state of flux. As new problems arise, they must change to ensure Facebook’s users are as protected on the site as they can be. Therefore, it is absolutely necessary that you stay on top of these changes and are aware of them as they are implemented. For example, in 2020, Facebook implemented a new policy requiring advertisements relating to the mortgage industry to fall under their Special Ads category.

Special ads category

The Special Ads category on Facebook relates specifically to advertisements relating to housing, credit, or job opportunities. Unfortunately, this kind of ad is very limited in its options, including a lack of saved audiences, location access, age or gender determination, and detailed targeting with certain demographics or income factors.

In light of this, it may seem wiser to not list your mortgage company’s ads in the Special Ads folder, as you lose access to vital tools. But know that if you falsify your ad type, there may be serious consequences, including removing the ad, a lowered page quality, or even your company’s removal and banning from Facebook activity in the future.

Technical difficulties with ads

In addition to breaking Facebook policies and guidelines, there are other reasons why your advertisement may not be successful. For example, if you are missing or have poor ad features, you can have a very low lead generation rate. Here are three factors that strongly play into an ad’s success:

Wordiness

If your advertisement is too wordy, people will likely scroll right past it without ever knowing what the ad was about. You need to take the time to hone your ad down to a few effective words as possible–the more concise, the better.

Broken URL

Another reason that your ad may technically fail is if the links you’ve attached are broken. If leads can’t access the information you’re trying to share, then the whole ad is a failure.

Using Facebook or Instagram trademarks

If you use Facebook or Instagram trademarks in your advertisements, it may also fail because each company owns the rights to those symbols. If you choose to use them, you may face serious legal repercussions.

3. Having a low Facebook page quality

Another factor that can cause Facebook ads to be ineffective for you is the condition of your company’s FaceBook page.

To have an effective Facebook ad campaign, you need to have a Facebook page to reference potential clients back to. If your page isn’t created and maintained to a certain quality standard, you won’t gain any new leads.

Suppose your pages keep getting flagged for violating Facebook community guidelines. In that case, your page will inevitably be given a low-quality rating on the site, putting any advertising campaigns you undertake at risk. There are several community guidelines that Facebook has put into place, and most of them are quite obvious rules, including the banning of pornographic photography of adults and children, hate speech, and bullying–with the exception of comments directed at or about public figures.

But there are other rules that may more easily be broken if you don’t know what to look for. For example, if you post any client information in a post, like a photo of completed mortgage loan documents, you can be flagged for revealing private information that may cause financial harm. Pages that are viewed as spam-like may be flagged, as well as those that misrepresent the company represented.

You can check your Facebook page’s quality by going to the “More” menu at the top of your page and selecting “Page Quality” from the drop-down menu.

4. Having a low landing page quality

You need to have a solid Facebook page before posting any ads. After all, one of the first things new leads will see after clicking on your ad is going to be that page. If you don’t post regularly, have low-quality posts, not updating your cover photos, or use personal photos instead of business-related images, people will likely click away from your site without learning anything more about your business.

Further, Facebook will check links to websites that you feature on your page and in your advertisements to ensure that they comply with existing ad rules. Here are some common reasons why an ad, linked website, or page may get flagged as low-quality

- A surplus of pop-ups: If you have a large number of advertisements on your Facebook page that are pop-up, you may be flagged as a spam account and have your account’s quality rating lowered. But even if it’s not, having pop-up ads can really weaken your lead generation because people generally find pop-up ads to be frustrating and distracting.

- Broken links: If your advertisements feature broken links, no one is helped by them. You won’t gain any new clients because they’ll never be directed to the right pages, and your clients may come away with a negative opinion of your company.

- Misleading content: If you are posting an advertisement to Facebook, make sure your ads are straightforward–don’t advertise anything irrelevant to the product you wish to promote. Doing so is misleading and will not draw in the clients you want because the product you feature is not the one being advertised.

Should you stop doing Facebook ads on your mortgage business?

Facebook ads can be great for your business, but you may actually hurt your business in the long run if you don’t know how to use them properly. New rules are constantly being implemented, and they can undeniably impact your lead generation. You need to be aware of them and follow them carefully to avoid losing company access to Facebook.

Remember, you can still generate massive amounts of leads from Facebook ads; you just need to change the way you advertise through the site.

Schedule a FREE strategy call with us to learn more about Facebook ads. Hiring a professional can help you save time and resources when creating the best campaign for you. Learn more about how our Unfair Advantage™ program has helped 1000s of loan officers.