Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Navigating the mortgage industry with confidence takes specialized education, training, and a lot of practice. Additionally, mortgage professionals looking to advance their careers may consider licensure. This article takes a closer look at the history of NMLS as well as NMLS licensure costs and requirements. An NMLS license may cost anywhere from $300 on the low end to more than $1k when taking into account pre-licensure education, examination fees, processing fees, and the ongoing education required to maintain the license.

Key Takeaways

- NMLS stands for the Nationwide Mortgage Licensing System and may also be referred to as the Nationwide Multistate Licensing System and Registry.

- NMLS houses licensure records for mortgage professionals across all US states and territories.

- The cost of getting an NMLS license depends on a number of factors.

It’s crucial to remember that the fees of obtaining an NMLS license are subject to change and that particular requirements may differ by state.

What Does NMLS Stand For?

NMLS is an abbreviation for the Nationwide Mortgage Licensing System or Nationwide Multistate Licensing System and Registry. The two names are often used interchangeably and refer to the same thing.

Where Did NMLS Come From?

Although it may sound like an organization itself, NMLS is actually owned and operated by the State Regulatory Registry LLC. This is important because NMLS does not grant or deny licensure. Instead, it acts as a record-keeping and accountability system. Its creation coincided with the passing of the SAFE Act which encouraged fair and transparent financial practices within the mortgage industry.

Together, the SAFE Act and NMLS set new precedents for the states when it comes to regulatory compliance. This is also why loan originators seeking licensure must participate in mandatory pre-licensure education before passing an NMLS-certified exam and officially applying for their license.

What is an NMLS Number?

An NMLS license includes a number that is permanently assigned to each individual who has an NMLS account. Although an NMLS number is tied to a specific person within a specific organization, loan originators are able to obtain multiple licenses in multiple states.

An NMLS license and NMLS number is proof of competence in giving loan advice. It also demonstrates that a loan originator fulfills national and state requirements, is current on their education, and follows industry laws. In addition to fulfilling state and national requirements, loan originators must complete a criminal history background check and pass a credit check. Moving forward, continuing education is required to maintain the license.

How Does the National Mortgage Licensing System Work?

The NMLS receives new license information for loan originators or mortgage firms and keeps their system updated. When mortgage loan officers renew their licenses, the NMLS records this information. If they change mortgage brokers, this change is also recorded in the NMLS. Every year, about 640,000 businesses and individuals use NMLS to manage their business license and registration obligations.

How NMLS Inspires Accountability for Mortgage Professionals

NMLS was founded on good intentions. Mortgage brokers and originators can authenticate their qualifications and trustworthiness through an unbiased third party as a result of this registration system and process. By placing your NMLS number in your social media profiles, for example, you can begin to build trust and credibility before leads and prospects book an appointment with you.

The process of obtaining a mortgage isn’t easy, and clients want to know that they’re making the right decisions. By bringing transparency to licensure, the public is free to verify information at any time and make better informed decisions about who they’d like to work with. NMLSConsumerAccess.org is a resource available to the public which allows anyone to confirm the status of a professional’s licensure.

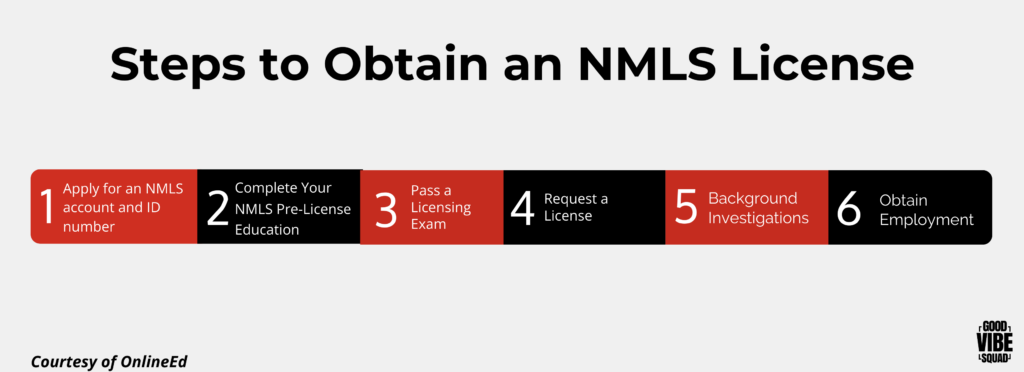

Steps to Obtain an NMLS License

- Apply for an NMLS account and ID number

- All application qualifications and materials can be accessed through the official NMLS website.

- Complete Your NMLS Pre-License Education

- Education requirements vary by state with most states requiring a minimum of 20 hours of pre-license education. You are responsible for researching the requirements of all the states that you want to do business in.

- Pass a Licensing Exam

- After completing the required coursework, it’s time to complete the official examination. To schedule your exam, please visit the NMLS Resource Center and the Individual Test Enrollments page.

- Request a License

- You must fill out and submit an application for a mortgage loan origination license through the NMLS website. In some cases, your employer may complete this for you, so be sure to double check with them!

- Background Investigations

- Most states require you to obtain a criminal background check as well as submit fingerprints and a credit report as part of the application process.

- Obtain Employment

- Your NMLS record must be associated with your employer before you can obtain a mortgage loan license and do business. This means you must grant access to your company through the NMLS portal.

NMLS Processing Fees

The below chart breaks down the typical costs associated with NMLS Processing Fees. It’s interesting to note that NMLS has not increased any of their most basic processing fees since the year that NMLS was created.

State Licensure NMLS Processing Fees

| Entity | Initial Set-up Fee | Annual Processing Fee | MLO Change of Sponsorship |

|---|---|---|---|

| Company (Form MU1 Filing) | $100 | $100 | $30 |

| Branch (Form MU3 Filing) | $20 | $20 | n/a |

| Individual (Form MU4 Filing) | $30 | $30 | n/a |

IMPORTANT: Per the official NMLS site, these fees may vary depending on agency and state.

Fees for NMLS Processing for Federal Registration

| Entity | Initial Set-up Fee | Annual Processing Fee | MLO Change of Employment | Two-Factor Subscription |

|---|---|---|---|---|

| Institution (Form MU1R Filing) | $100 | $100 | n/a | $55/user |

| Individual (Form MU4R Filing) for 2011 | $60 | $0 | $30 | n/a |

| Individual (Form MU4R Filing) for 2012 and subsequent years | $30 if registration occurs between January and June. $60 if registration occurs between July and December. | $30 ($0 if registration occurred between July and December of same year.) | $30 | n/a |

Fees for Professional Standards

| Item | Fee |

|---|---|

| Criminal Background Check | Livescan - $36.25 or Print Card Capture - $36.25, plus Card Packet Fee - $10 Charged at each new application for licensing or new request for registration. Single charge regardless of how many licenses are applied for in a single filing. |

| Testing | National Component - $110 |

| Credit Report | $15 Charged at each new application for licensure if NMLS does not contain a credit report that is less than 30 days old. Single charge regardless of how many licenses are applied for in a single filing. |

Fees for Educational Providers

Fees are assessed to organizations in order to maintain their status as a “NMLS Approved Educational Provider.”

1. Provider Application Fee: $400

2. Provider Renewal Fee: $400

3. The course approval fee is $300, plus $20 each credit hour.

4. The course renewal fee is $200, plus $20 each credit hour.

5. The credit banking fee is $1.50 per credit hour accumulated.

What Are the NMLS Processing Fees Used for?

NMLS Processing Fees go towards improving NMLS operations and development. This includes maintaining the system itself, maintaining strict data protocols, maintaining records, running the NMLS Call Center, and regularly updating the NMLS Resource Center.

NMLS has made great improvements since its inception in 2008 with a goal of streamlining the compliance process for licensees. The digital system continues to save loan originators time as they can submit documents and track their application status all in one place.

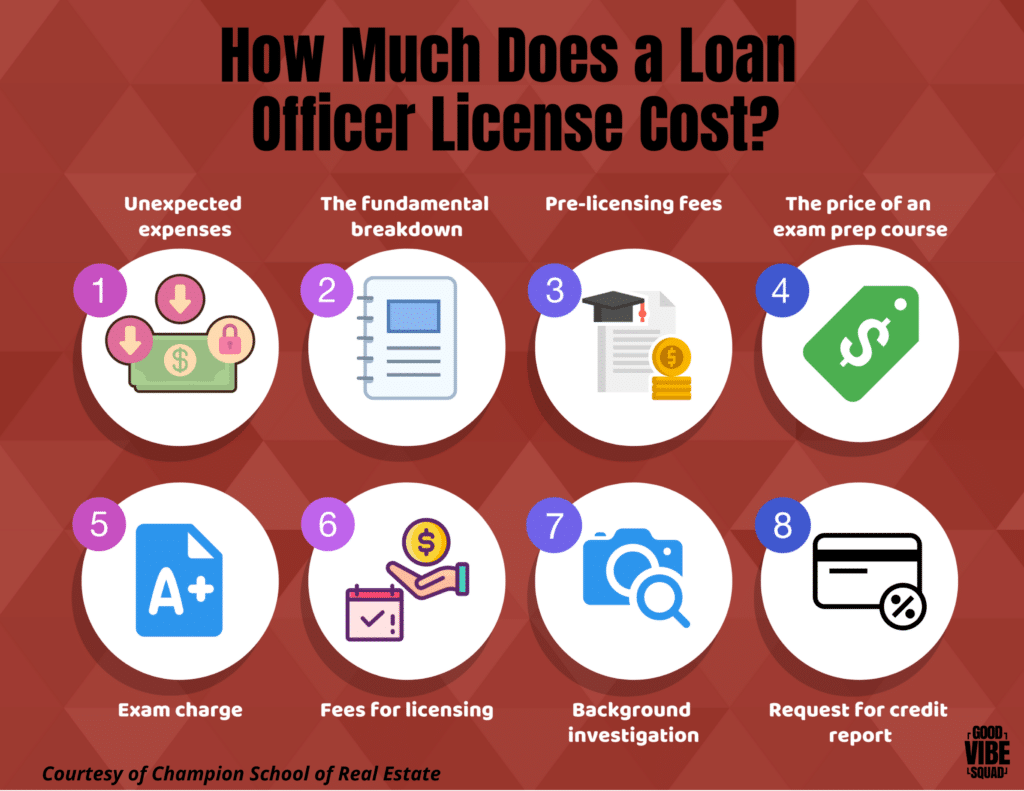

How Much Does a Loan Officer License Cost?

The cost of a loan officer license is comprised of six types of charges: unexpected expenses, the fundamentals, pre-licensing fees, exam prep, the exam charge itself, licensing fees, and background check fees.

Unexpected Expenses

If you’re interested in getting licensed in different states, it’s always smart to set aside additional funds in case these states require additional coursework and pre-licensure education. Other unexpected expenses may also include marketing your new licensure.

A Breakdown of Fundamental Costs

The table below depicts the typical expenditures associated with each stage of the licensing process for loan officers:

| Requirement | Cost |

|---|---|

| 1. Pre-licensing courses (national SAFE comprehensive course plus state requirements) | $230−$719, depending on state and delivery method |

| 2. Exam prep course | Free with pre-licensing course package, $235 by itself |

| 3. National exam | $110 |

| 4. Licensing | State-specific fees − *see next section NMLS processing fee − $30 FBI background check − $36.25 Credit report request − $15 |

Pre-licensing Fees

To get your individual MLO license, you must complete a minimum of 20 hours of NMLS-approved courses, regardless of where you live in the United States. The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act mandates this requirement. The additional pre-licensing requirements differ from state to state.

In Texas, for example, pre-licensing courses range from $485 to $719, depending on the curriculum. At $480, the most cost-effective curriculum contains the SAFE Comprehensive courses as well as the 3-hour Texas prerequisite, TX-SML SAFE: Texas Law and Practice. In contrast, the $719 curriculum contains all of the above, as well as training on how to advertise oneself as a new MLO, business etiquette, and important mortgage skills. The cost of these loan originator education programs will vary by institution.

The Price of an Exam Prep Course

All MLO students should consider taking the Loan Officer Exam Prep course. Students who take this course have a considerably better chance of passing the national exam which is notoriously difficult for first timers. This course is free with the purchase of most applications but costs $235 if purchased alone.Exam Charge

The national exam is $110 for all test-takers across the country. The cost includes both exam proctoring and all testing materials. Remember: the test must be taken at an approved testing facility.Fees for Licensing

Depending on where you live, you may be required to pay a sponsorship charge, a recovery fund, and other licensing fees.

To view state-specific fees, go to the NMLS website and select your state.

Background Investigation

A federal background check is required to finalize your license. This typically costs $36.25.

However, in some areas, you will be required to pay for a state background check in addition to the federal check. To see these prices, go to the NMLS website and select your state.

Request for Credit Report

It is critical that you have a track record of fiscal responsibility and honesty as a home loan originator. You must submit a credit report as part of the licensing process to demonstrate that you have a decent financial background. It is typically a flat rate of $15 everywhere.

The Cost of Continuing Education

The cost of NMLS continuing education varies depending on the provider and the exact courses taken. NMLS-approved providers provide a variety of courses to help mortgage loan originators achieve their continuing education needs.

Mortgage loan originators must typically complete 8 hours of NMLS-approved continuing education per year. On average, the cost of a course hour ranges from $15 to $25. As a result, the total cost for the minimum 8 hours of continuing education could range between $120 and $200.

Keep in mind that these rates are subject to change, so for the most up-to-date information on continuing education expenses and requirements, visit the NMLS website. Furthermore, rules and costs may differ according to the state in which you are licensed, so keep your specific region in mind when considering charges.

Already Licensed and Ready to Scale Your Mortgage Business?

Give our team a call and see how we’ve helped hundreds of loan originators all over the country close and fund billions of dollars of loans directly from our proven process and systems. We work with loan originators old and new to transform their production, their business, and their relationships.