Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

Key Takeaways

- Loan officer assistants wear many hats and help loan originators facilitate the process of helping clients obtain a mortgage.

- Becoming a loan officer assistant doesn’t require any specialized training or licensure, but certain skills can make a big difference.

- Delegating some of your tasks to a loan officer assistant can help you scale your business.

Understanding the Role of a Loan Officer Assistant

Loan officer assistants play a key role in supporting loan officers and ensuring the loan origination process goes smoothly. This is a role that involves juggling several tasks simultaneously and working diligently to solve problems as they arise. This position may be performed remotely depending on specific state statutes and business regulations.

The next section takes a deeper look at some of an LOA’s main responsibilities and duties.

Key Responsibilities of an LOA

These are some of the most common LOA responsibilities. Keep in mind that this list is not exhaustive and the job of an LOA involves wearing many hats.

Dealing with Loan Documentation

One of the primary responsibilities of a Loan Officer Assistant is handling loan documentation. They are responsible for reviewing loan paperwork, verifying the accuracy of loan documents, and ensuring that all necessary documents are complete within the necessary timeframe. This includes reviewing loan applications, credit reports, income statements, and other financial documents. They are also responsible for updating loan files and maintaining accurate records.

Assisting in Loan Processing

Another key responsibility of a Loan Officer Assistant is assisting in loan processing. Although they cannot actually process the loan themselves, LO assistants may work closely with loan officers and underwriters to ensure that loan applications are processed efficiently and accurately. Sometimes, this may also involve ordering appraisals or coordinating with third-party vendors.

Customer Service and Communication

LO assistants are often the first point of contact for prospective clients. They are responsible for providing excellent customer service and communication throughout the loan process and representing their team in a professional manner. This includes answering client inquiries, providing updates on loan status, and addressing any concerns or issues that arise. They must be able to communicate effectively with clients, loan officers, underwriters, and other stakeholders.

Required Skills and Qualifications

To become a successful loan officer assistant, individuals need to have a basic education, technical skills, and interpersonal skills. Here are some of the essential qualifications that they should possess:

Educational Background

A high school diploma or GED is often the minimum requirement for becoming a loan officer assistant. That being said, most employers tend to prefer candidates with a bachelor’s degree in finance, economics, accounting, or a related field. Having a degree in a relevant field will give individuals a better understanding of the financial industry and make them stand out from other candidates.

Technical Skills

Loan officer assistants need to have a strong understanding of the lending process and be proficient in using loan origination software including CRMs. They should also have excellent analytical and computation skills to evaluate loan applications and financial statements accurately. Other technical skills that are essential for a loan officer assistant include:

- Knowledge of federal and state regulations related to lending

- Familiarity with loan documentation and underwriting procedures

- Proficiency in using Microsoft Office Suite, including Excel and Word

- A basic understanding of email etiquette

- The ability to conduct research as needed

Interpersonal Skills

Loan officer assistants need to have excellent communication and customer service skills to interact with clients, loan officers, and other stakeholders. They should be able to explain complex financial concepts in simple terms and make clients feel like they are being taken care of. Other interpersonal skills that are essential for a loan officer assistant include:

- Ability to work independently and as part of a team

- Problem-solving and decision-making skills

- Flexibility and adaptability to changing situations

- De-escalation and conflict management

Career Path and Opportunities for Advancement

At the intersection between the mortgage and financial industry, LOAs have the unique opportunity to pick up a number of transferable skills.

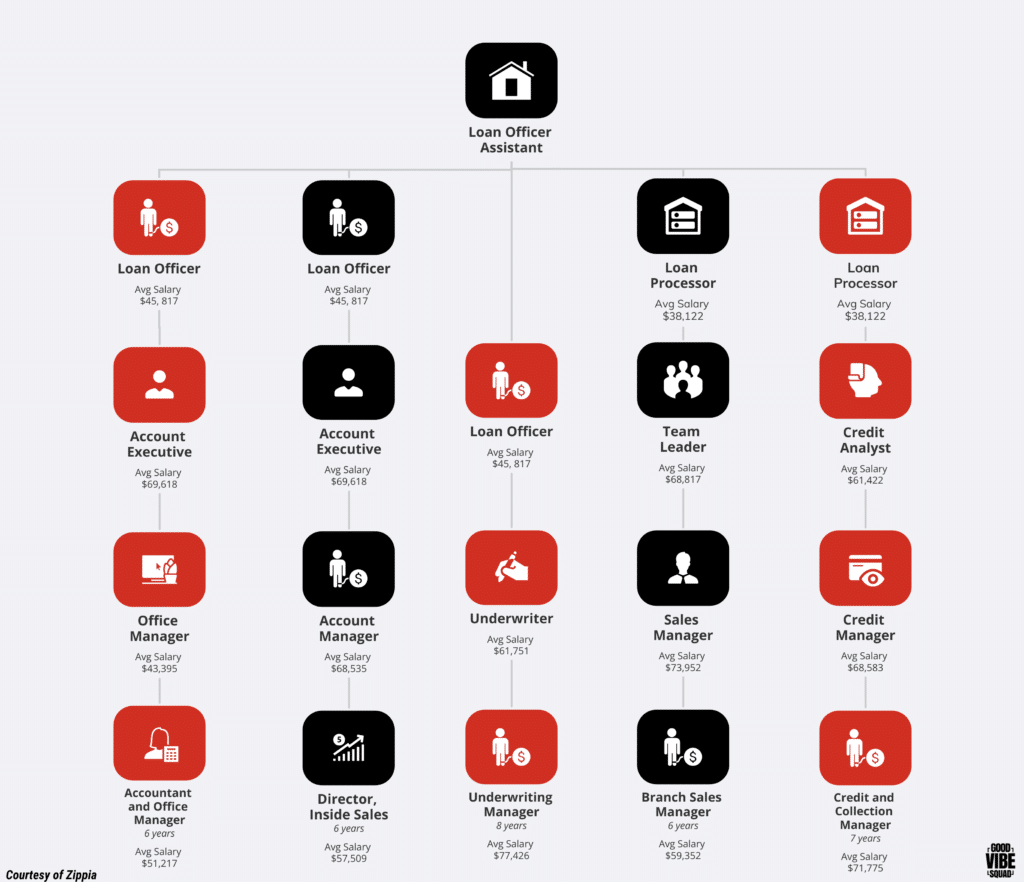

As they grow in their roles, LOAs can advance their careers and take on more responsibilities in the future such as transitioning to becoming a Loan Officer, Office Manager, Underwriter, or Branch Manager among several other titles and career paths. These different career paths are outlined on Zippia and down below.

Employment Outlook

According to The Bureau of Labor Statistics, the financial and business industries are projected to grow by 7% from 2021 to 2031, which is the average for all occupations.

Additionally, loan officer assistants may be able to work in a variety of financial institutions, including mortgage companies, commercial banks, credit unions, and other financial institutions. This flexibility can provide more opportunities for advancement and career growth.

How LOAs Can Help You Scale Your Mortgage Business

Loan officer assistants are integral to carrying out the systems and processes that keep your business and your team on track. For every phone call or follow up that they take off your plate, you “buy back” more of your time to focus on high level tasks and revenue generating activities. This is something Preston and I talk about on our coaching calls with our members every week.

If your tasks are beginning to feel overwhelming, this may be a sign you’re ready to hire an LOA. Scaling requires delegating, and delegating requires hiring people you can trust.

Learn More About Our Award-Winning System and Process for LOs to Scale Their Business

Good Vibe Squad’s proven process and system meets loan officers where they’re at and gets them where they want to go. With hundreds of active members and billions of dollars of closed and funded loans that can be attributed directly to our system, we’ve got the track record and team of specialists that can help you increase your production and decrease your stress (which we all know is particularly high in this industry).

Learn more about our guarantee and Schedule a call with our team today!