Yes, loan officers can indeed work from home with some slight caveats.

According to Stanford Economist Nicholas Bloom, 42 percent of the U.S. labor force is now working from home. While the COVID crisis sparked a huge rise in the need for employees to work from home with lockdowns and quarantines, many companies are now finding success with work-from-home positions. While many companies were hesitant, they are now seeing the benefits. While many state regulatory agencies and companies still restrict loan officers to working in licensed facilities, the pandemic brought many changes that now allow most loan officers to work from home.

However, working from home successfully is not for everyone, and there are a few things to consider before taking this step.

Key Takeaways

- Loan officers can work from home, but it’s important to check if it’s allowed in your area.

- Loan officers evaluate loan applications, authorize loans, and are responsible for finding clients seeking loans.

- Loan officers need a dedicated home workspace with fast internet and a workstation with necessary equipment.

- They also need to market themselves and maintain a professional network, and create a mobile office to stay connected with clients.

- Loan officers need to create a schedule, set goals, and maintain a work-life balance to avoid burnout and maintain mental health.

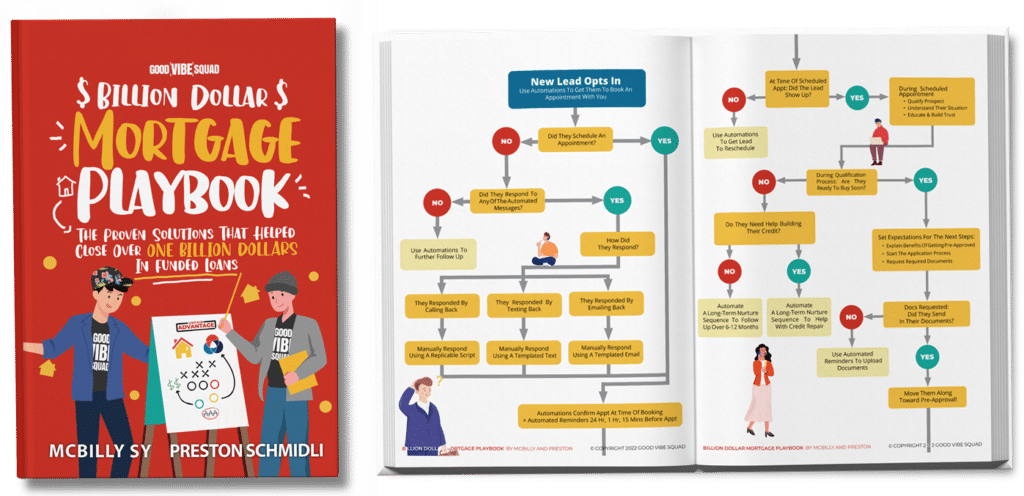

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

What do loan officers do?

Loan officers are employed by commercial banks, credit unions, mortgage companies, car dealerships, financial services, and other financial institutions. They are responsible for evaluating, authorizing, and recommending the approval of loan applications. A loan officer evaluates an applicant by looking at their background and determining if the loan candidate is a good risk and likely to pay back the money they borrow. In addition, they are often responsible for finding clients seeking loans, meaning they work to make connections with realtors, car sales associates, or other business professionals in the hopes of generating business.

A loan officer working from home

While most loan officers or mortgage lenders work in a financial institution, many are making the transition to home-based operations, either part-time or full-time. While some regulating agencies still require loan officers to work in their financial institutions, this is changing in many areas. Before you consider transitioning to a work-from-home position, make sure your area allows for it. While many people think the idea of working from home sounds great, it can be a challenge if you are not prepared for the changes.

Creating your home workspace

When creating your work-from-home space, there are many things to consider to be successful. Probably one of the most important things to consider is your internet. While most home internet works for your basics, as a loan officer working from home, your day will likely rely on emails, video calls, and large corporate files. You need internet with at least 100 megabits per second to ensure that you can keep up with your demand.

Once your internet is in place, you need to focus on your workstation. What do you need to complete your daily demands? This can include computers, monitors, keyboards, laptops, filing systems, and more. In many cases, the financial institution you work for will provide these items or offer to purchase the required items for your home office.

Marketing yourself when you work from home

When working from home, you are not as likely to come into face-to-face contact with potential clients, so it is important that you still work on marketing yourself in other ways. The digital age provides many opportunities to do just that. Managing your Facebook, LinkedIn, and Zillow pages is essential to keep you in front of potential borrowers. In addition, joining outside networking groups is a great way to get out of the office and build effective network relationships.

Finding the right lender to work with

Unfortunately, not all companies have accepted the work-from-home culture. If your goal is to work from home, you need to find financial institutions that accept the remote lifestyle. Not only do these companies allow you to thrive from home, but they also continue to work to build a team by holding bi-annual retreats, virtual town halls, or more to enhance the sense of teamwork between in-house and at-home members.

How to be a successful loan officer when working from home

Working from home is not for everyone and it takes some changes to be successful. These tips can help ease your transition and promote success, even if you are only working from home part-time.

Setting your goals

As a licensed mortgage loan originator or loan officer working from home, you don’t have someone there to keep you accountable. You must rely on yourself in setting and meeting goals. Establishing daily, weekly, monthly, and yearly goals and making sure you meet these goals is essential. Start by thinking about what you want to accomplish this year and determine what you need to do to make that happen. Think about things like how many calls you need to make each day, how many appointments you need each week, and how many lead generations you need per week to meet your goals.

Creating and following a schedule

Working in an office setting or other traditional work location typically has a regular work schedule. You get to the office at a certain time, take a scheduled break and lunch, and finish your day at closing time. Working at home is a little different, but you still need to establish a regular schedule to stay productive. While this schedule does not need to follow your traditional office schedule, you want to make sure you follow the same routine hours every workday. It can become very easy to overwork when working from home, so creating a regular schedule also helps reduce burnout and ultimate failure when working at home.

Creating a separate workspace

While it may seem like a luxury to work from home with your laptop on the coffee table or some other random spot in your home as the day progresses, this can reduce your productivity. When it comes to working from home, you need to create a comfortable work environment that is dedicated to your work. A place where you can open the door when your work hours start and close the door at the end of your workday.

Having a full office set-up allows you to focus on your work and meet your daily goals without tracking down something you forgot or don’t have readily available.

Managing an active professional network

As we mentioned earlier, working from home can become isolating, so it is important to allow time to focus on your professional network. This can include other loan officers, mortgage brokers, financial professionals, mortgage bankers, and real estate agents. This can include everything from your Facebook, LinkedIn, and Zillow pages to local community networking and professional groups. These resources help keep you active and put you in front of people who can help you grow your business.

Establish a mobile office

Whether you are working from a traditional office or have transitioned to working from home, creating a mobile office allows you to connect with your clients even when you are away from the office. As a mortgage loan officer or mortgage loan originator, your goal is to nurture your client relationships, and the addition of a mobile office where clients can reach you through phone or text no matter where you are helping to build stronger relationships. Being able to quickly respond to clients through a quick text or phone call helps them feel that their business is important to you, and, in the digital age, everyone is looking for a response as soon as possible. A mobile office gives you the opportunity to stay better connected.

Maintain an active social presence

In today’s digital world, it is essential for a business to maintain an active social media presence, and not just for professional networking and generating business referrals. This is even more important if you are working from home as opposed to a traditional office setting where clients can meet with you in person. Creating and maintaining active social media accounts on sites such as Facebook, LinkedIn, and Twitter gives you the opportunity to put a face to your name, actively engage with potential clients, and share your industry knowledge with a much larger audience.

Consider a flex plan

While working from home can be a great option for loan officers and loan processors, it is important not to forget your traditional office completely. Your traditional office offers many different benefits that you can’t find at your home office, such as interaction with your coworkers. Developing a flex schedule where your work primarily from your home office while still going into your main office one or two days a week offers you the benefits of both and can help keep you focused on your goals.

Include continuing education in your schedule

When working from home, it is easy for mortgage lending professionals to get into a routine of doing the same thing over and over, even if it isn’t proving as successful as you’d hoped. It is important to not fall into this habit and find ways to constantly work toward growth and improvement. One way to achieve this is through regular continuing education and growing your industry knowledge. This can include everything from attending industry seminars to simply listening to a regular mortgage industry podcast during the week. Continuing to grow your industry knowledge will also allow you to further educate and inform your clients while showing them that you are an industry leader.

Understanding the work-from-home lifestyle

While the idea of working from home can seem appealing, it doesn’t come without challenges. Every person adjusts to changes differently. For example, some may consider working from home the same as remote working, meaning they wake up early to make breakfast, shower, and put on traditional business attire. Others will simply sleep in, make a quick breakfast, and get to work. When transitioning to the work-from-home lifestyle, it is important that you find what works for you. Here we take a look at some of the advantages and disadvantages associated with working from home.

Benefits of loan officers working from home

- Flexible schedule, giving you more time with friends and family

- No morning and evening commute, allowing for a shorter workday

- Reduced expenses thanks to lower gas use and the ability to eat from home

- More time to spend on things you enjoy

Downsides of loan officers working from home

- Limited interaction with coworkers and colleagues

- Changes to workplace relationships

- Can be a challenge with large families and smaller children to remain focused on work

- Difficult to maintain a work-home balance if you do not follow a routine work schedule

- Feelings of isolation and an increased risk of stress, anxiety, or a drop in production

Working from home and mental health

Working from home can be beneficial for many loan officers when certain factors, such as following a regular work schedule and building a professional network, are followed. If not, it is very easy to become overworked or underperform, as well as begin to feel isolated. These conditions can contribute to an increased risk of stress, anxiety, and depression. The good news is that there are things you can do to help promote success as well as maintain quality mental health.

- Stick to your work schedule. As we mentioned before, it is important to create a work schedule when working from home. Once created, it is even more important that you stick with it. Focusing on work and productivity during business hours but shutting the door when your office hours are over helps you maintain a healthy balance between work and your personal life.

- Maintain regular communication. Working from home can often seem isolating. It is important to build and maintain a strong professional network that you engage with on a regular basis. This can be through video calls, emails, and even going out to meet for coffee during the week.

- Continue to take breaks. When working from home, it can be easy to make a quick lunch and work through lunch. However, it is important that you take breaks during your work hours. While you may not have a break room to socialize with coworkers, a simple walk around your neighborhood can give you the mental break you need to remain productive throughout the day.

- Limit connectivity. When working from home, it is easy to maintain a connection to work even after business hours. Your computer or mobile phone is right there, so it is easy to reply to a quick email or read the newest article. However, it is still important that you take the time to unplug from work and focus on other topics.

Always strive to grow

Working from home is often the perfect environment for many loan officers. However, there are some important things to remember. When you work in a traditional office setting, other agents are pushing you to match your success. When you work at home, you must push yourself to achieve the success you strive for. This means you need to spend time increasing your knowledge and growing yourself and not getting stuck doing the same thing over and over again with no growth.

Here at Good Vibe Squad, our team has developed a mortgage lead generation system to help you build and grow your business from home. Schedule a strategy call with us today to learn more.