If you are considering a career as a mortgage loan officer, you are not alone. In fact, U.S. News lists a loan officer in the top 10 careers in the business jobs category. But what does it take to become a loan officer require? What licensing is required? Do you need specific training? Here we look at exactly what a loan officer does, and the steps required to become licensed and maintain your license.

Key Takeaways

- Loan officers determine if individuals or corporations qualify for loans from banks or other financial institutions by examining their financial records and determining their ability to repay the loan.

- To become a loan officer, you need to have strong customer service skills, be detail-oriented and organized, possess strong sales ability, and be decisive in your decision-making skills.

- You must undergo an extensive background check and complete pre-licensing education courses before obtaining a license from your respective state and registering with the National Mortgage Licensing Service (NMLS).

- Certifications, although not required, can improve your employment prospects and provide further education and specialty training to help you stand out above your competition.

- Once you receive your license, you must complete continuing education courses each year to renew it and keep all your information current with the NMLS.

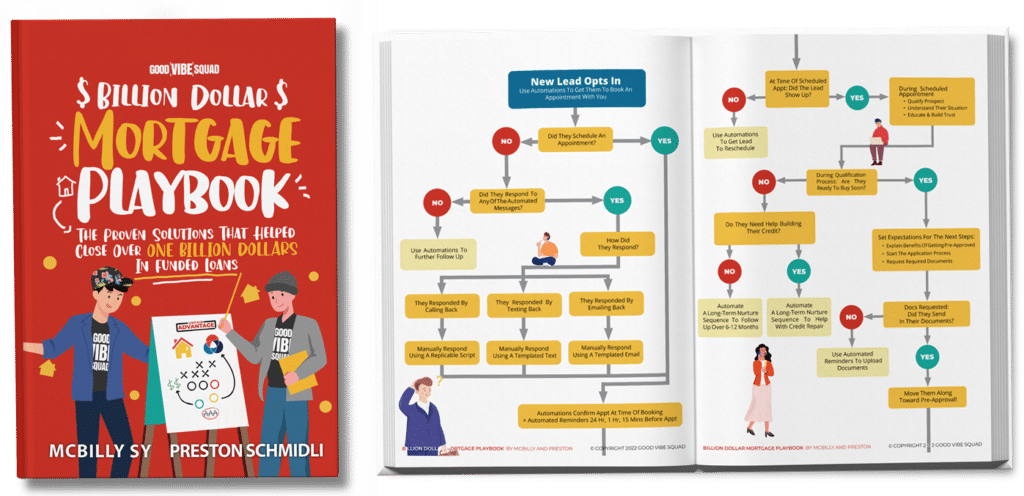

Get Our Billion Dollar Mortgage Playbook

Get the proven strategies that helped close Billions of dollars in funded deals!

What does a loan officer do?

Loan officers work to determine whether corporations or individuals qualify for loans from banks or other financial institutions. To do this, they examine the applicant’s financial records and, using underwriting principles and specific formulations, work to determine the applicant’s ability to repay the loan. It can include the examination of things like income, income-to-debt ratio, job stability, and assets.

In addition to working numbers, loan officers must also possess excellent customer service skills. Not only are you required to find clients for loans, but you are also working with people, families, and corporations and walking them through the loan process, often through major milestones of their life. Common duties of mortgage loan officers include:

- Identifying potential homebuyers and loan applicants through advertising, networking, etc.

- Gathering all the necessary information from applicants

- Presenting loan options that work with the applicant’s needs and means

- Keep accurate records

- Coordinate with other professionals, such as appraisers and underwriters

Loan officer requirements and career

A loan officer is responsible for assisting customers in obtaining a mortgage loan that meets their needs. In order to do this, they identify potential homebuyers, or leads, compile all the necessary borrower information, present loan options to the borrowers, and work with underwriters and appraisers to secure the mortgage, allowing the home buyer to purchase the home of their dreams.

In order to become a loan officer, there are a number of requirements, including:

Becoming a loan officer

In order to become a loan officer, there are a variety of different steps you must take. This begins with experience, and this is even more important if you do not have a bachelor’s degree. Working for 2-5 years in the finance industry, such as a customer service rep, bank teller, or sales, will help provide the necessary experience in order to obtain a license and begin as a mortgage loan officer. As you continue on your licensing journey, these other steps are essential.

1. Your personal qualities

When you are considering becoming a mortgage loan officer, it is important for you to evaluate your personal qualities in order to help determine if this career path is a fit for you. Evaluating your skills and personal strengths will help you determine areas you may need to improve upon in order to be successful.

What skills are needed to become a loan officer?

- Strong customer service skills: Loan officers work with people every day and it is important that they possess strong customer service and communication skills.

- Detail-oriented and organized: Loan officers are required to sort and evaluate multiple documents and determine whether or not a borrower will qualify for a loan. They need to be able to focus on the details to ensure nothing is missed.

- Strong sales ability: In order to gain clients, a mortgage loan officer must be able to sell their services and bring in clients for mortgages.

- Decisive: Once all the borrower’s information is collected, a mortgage loan officer must be able to interpret the information and decide if the applicant is a good candidate or not, so you must be confident in your decision-making skills.

As a loan officer, knowledge is essential, and you should never stop learning. For example, as a mortgage loan officer, you should have knowledge of the ever-changing real estate industry. If you are always looking to learn something new, then a mortgage loan officer may be the perfect fit for you.

2. Examine your personal history

Loan officers work with banks and lending institutions every day. Because of this, loan officers must undergo extensive background checks, looking at things like your credit reports and credit history, foreclosure history, defaulted loans, fraud-related criminal history, and more. A person must have financial character and stability to become a loan officer.

3. Pre-licensure education, requirements, and certification

The National Mortgage Licensing Service (NMLS) is the regulatory body for all mortgage loan officers and to become a loan officer, you must take pre-licensing education, pass license testing, and submit the required information. While some enter this field with degrees in banking or business, the only traditional education requirement is a high school diploma. The educational focus for this career falls in the licensing requirements. Let’s take a closer look at each step.

Pre-license Education

All potential mortgage loan officers must complete a pre-licensing education course. This course includes the required base of 20 hours, though each state may have additional education requirements, so it is important to check with your state before beginning a pre-license course. Topics included in the base 20 hours include:

- 3 Hours of Ethics – this covers fraud, consumer protection, and fair lending.

- 3 Hours of Federal Law and Regulations

- 2 Hours Nontraditional Mortgage Product Market

- 12 Hours of Mortgage Origination Instruction

The Safe Act requirements

While each state is different when it comes to education hours and requirements, there are some requirements that every applicant must submit. Based on the Secure and Fair Enforcement Act for Mortgage Licensing of 2008, all mortgage loan officers must adhere to the following guidelines:

- Provide authorization to obtain a credit report

- Provide necessary identifying information

- Undergo a criminal background check, including fingerprinting

- Provide financial services employment history for the past 10 years

- Disclose any financial regulatory charges against them

- Obtain license from their respective state

- Register with the NMLS

- Attest that all information is accurate and complete

NMLS testing and requirements for licensure

All applicants are required to pass the SAFE MLO licensing test with a score of 75% or above. This test covers the applicant’s knowledge of state and federal mortgage lending law. If you fail the test the first time, you must wait at least 30 days to retake the test. This is the same for your second attempt. If you fail your third test, you must wait 180 days before retaking the test.

Other requirements include:

- Fee payment: Applicants must pay all required fees to obtain their license. These fees vary by state.

- NMLS Unique Identifier: Every company or individual with an NMLS account is assigned an NMLS Unique Identifier number and is designed to track all mortgage-related services, including advertising.

- Sponsorship: Individual mortgage loan officers must be sponsored and supervised by an employer, and each state must approve of each sponsorship.

Certifications

Certifications are not required for loan officers but can help improve your employment prospects as well as provide further education and specialty training to help you stand out above your competition. These certifications are offered through the Mortgage Bankers Association (MBA) and the American Bankers Association (ABA) and include continuing education courses and an exam. Each certification must be renewed on a regular basis, often every three years. Some examples of certifications include:

- Certified Financial Marketing Professional (CFMP)

- Certified Lender Business Banker (CLBB)

- Certified Trust and Financial Advisor (CFTA)

Maintaining your loan officer license

Once you receive your license, you are ready to go to work. However, your education does not end with your pre-license course. Every active mortgage loan officer must renew their license each year and that requires continuing education courses. It is your responsibility to complete this education and all the requirements for renewal and failure to do so could result in you losing your license. In addition, you must keep all your information current with the NMLS. For instance, if you change companies, you must inform the NMLS.

Continuing education

In order to renew your license, you are required to complete continuing education. If you fail to complete this education, you are at risk of losing your license. Continuing education requirements typically include:

- 3 hours of federal law and regulations

- 2 hours of ethics

- 2 hours of non-traditional mortgage lending training

- 1 hour of undefined instruction or state-specific requirements

Frequently asked questions

While we have provided some basic information on becoming a mortgage loan officer, here is some additional information answering some frequently asked questions.

1. How long does it take to become a mortgage loan officer?

How long it takes to become a loan officer depends on where you want to work. Some banks of financial institutions require a bachelor’s degree before taking the pre-licensing exam. In this case, your degree can take up to four years before you begin your pre-license education. Pre-license education can take a few weeks to a few months.

2. What education is required to become a loan officer?

While only a high school diploma and a pre-licensing education course are required to become a mortgage loan officer, many banks and financial institutions also require a bachelor’s degree.

3. Can you become a loan officer while working another job?

Yes, you can do your pre-licensing education on a full-time or part-time basis, meaning you can pursue your education and career change while working another job.

4. Can I become a loan officer in multiple states?

If you live near the border of multiple states, holding a license in one or more states can often be beneficial. As a mortgage loan officer, you can hold as many different state licenses as you want, as long as you meet each state’s requirements and are registered with the NMLS in each state.

Take the next step in your career

If you are interested in pursuing a career as a mortgage loan officer, do your research in both the mortgage and the estate fields to help boost your knowledge and improve your chances of success. The information we have provided will help guide you through the process and, once you begin working as a mortgage loan offer, we are here to help.

The team at Good Vibe Squad has created the Unfair Advantage™ program to help you build and grow your business once you get started. Schedule a strategy call with us today to learn more.